This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

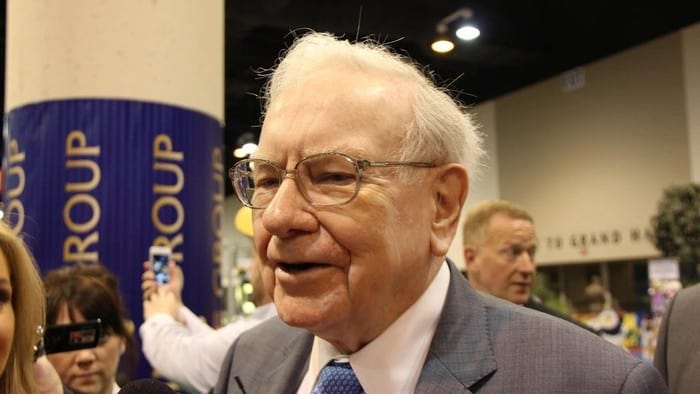

tIn the first quarter of the year, Warren Buffett and his company Berkshire Hathaway (NYSE: BRK-B) initiated a small stake in the digital consumer bank Ally Financial (NYSE: ALLY), which is also a big auto lender. In the second quarter of the year, Berkshire more than tripled its position in the stock, purchasing more than 21 million shares in the quarter. Now, Berkshire's position in Ally amounts to 30 million shares valued at more than $1 billion, representing nearly 9% of the company. With Buffett and Berkshire buying heavily now, is Ally a buy? Let's take a look.

Wall Street has grown bearish

Interestingly, Buffett is piling into Ally as the Street is growing more bearish. After a strong second-quarter earnings report, a number of analysts downgraded the stock on concerns regarding funding and credit quality.

Ally has been bolstered in recent years by a shortage of car inventory and elevated car pricing and interest rates, which have boosted financial results. Ally's retail auto loan portfolio at the end of the second quarter reached more than $82 billion, up 8.4% on a year-over-year basis. As the Federal Reserve has hiked interest rates, margins have also expanded significantly.

This has helped Ally generate a core return on tangible common equity (ROTCE) of more than 23% in the second quarter, which is superb. Furthermore, management said on Ally's second-quarter earnings call that they have been originating auto loans at an 8% yield in the third quarter while still maintaining their underwriting standards.

But analysts are worried about what will happen when car prices normalize, and how consumers will fare now that stimulus programs have winded down and economic conditions are more difficult. In the second quarter, Ally saw 30-day delinquencies in its retail auto portfolio jump by 0.50%. Also in the quarter, Ally started to see its deposit costs climb, which will keep climbing this year along with interest rates and could begin to cut into the bank's margins.

Why is Buffett buying?

Let's remember a few things when we talk about Buffett and Berkshire's investing philosophy: They both like to invest on a long-term basis and they both know the car business quite well.

Berkshire first invested in General Motors (NYSE: GM) in 2012, although it actually trimmed its position in the company in the second quarter. Ally was a financing division of GM called the General Motors Acceptance Corporation up until 2006, when GM sold a controlling interest in the company. Eventually, General Motors Acceptance Corporation would apply for a bank charter and rebrand into Ally.

Ally's management team does seem prepared for the normalization of auto prices and said they have assumed that used car prices, which are up 60% since 2019, will come down by 30% from the end of 2021 and 2023. The bank is also reserving for future losses prudently when you consider it is still not seeing huge cracks in credit quality just yet.

In addition, Ally has also done a much better job of improving its funding base and relationship with customers. In 2018, only 64% of its funding base came from deposits. Now, more than 85% of its funding comes from deposits. Also, Ally now offers mortgages, credit cards, point-of-sale lending, and wealth management, all of which can help create better relationships with consumers and hopefully lead to more primary banking relationships and a higher-quality deposit base. Ally's deposit costs are still fairly high compared to other large banks, but it seems like the company has really improved this aspect of the business and can continue to do so.

Finally, Ally believes its returns are going to continue to be higher post-pandemic. Prior to the pandemic, the company would at best generate a 12% ROTCE. Now, management has guided for a 16% to 18% ROTCE in 2022 and on a medium-term time horizon.

A value play for Buffett

Buffett and Berkshire have long been value investors, and Ally gives them the opportunity to purchase an asset that they believe is trading for less than its fair value. Ally currently trades at about 105% to its tangible book value or net worth, and at about five times forward earnings.

Companies generating and guiding for the kind of returns that Ally is would normally trade at a much higher valuation, so the market is clearly skeptical of how sustainable the returns are. But Buffett and Berkshire clearly like the risk-reward setup here, which I think is favorable considering Ally's low valuation. Ally also pays an annual dividend yield in excess of 3% and buys back a lot of stock, two other things Berkshire and Buffett find attractive. Overall, I agree with Buffett and Berkshire and do think Ally is a buy at these levels.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.