The Westpac Banking Corp (ASX: WBC) share price ended Friday in the red, down 0.2% to $19.90. It comes as a number of bidders are reportedly lining up to acquire the bank's investment platform business, when it attempts to sell in August.

Reports have surfaced suggesting Westpac has various finance giants interested, ranging from asset managers and investment banks to private equity.

Westpac's $1 billion divestment

It's understood that non-binding bids for the bank's planned divestment of its investment platform segment have come in at around $1.2 billion.

This was below Westpac's expectations of around $1.5 billion, The Australian reports.

Meanwhile, the intended sale – planned for next month – is facing inquisitions from a number of players interested in participating in the bid.

Bain Capital and Colonial First State are purportedly interested, while Macquarie Group Ltd (ASX: MQG) and AMP Ltd (ASX: AMP) were reported to be "best-placed to buy the unit", The Australian said.

The planned sale comes at the same time rival banking giant Australia and New Zealand Banking Group Ltd (ASX: ANZ) looks to acquire accounting software firm MYOB in a $4.5 billion transaction.

ASX-listed banks had a tough day on Friday after US investment banking giant JPMorgan Chase & Co posted weaker earnings overnight and announced it was set to wind back its buyback program. The S&P/ASX 200 Financials Index (ASX: XFJ) ended the day's trading down 0.39%.

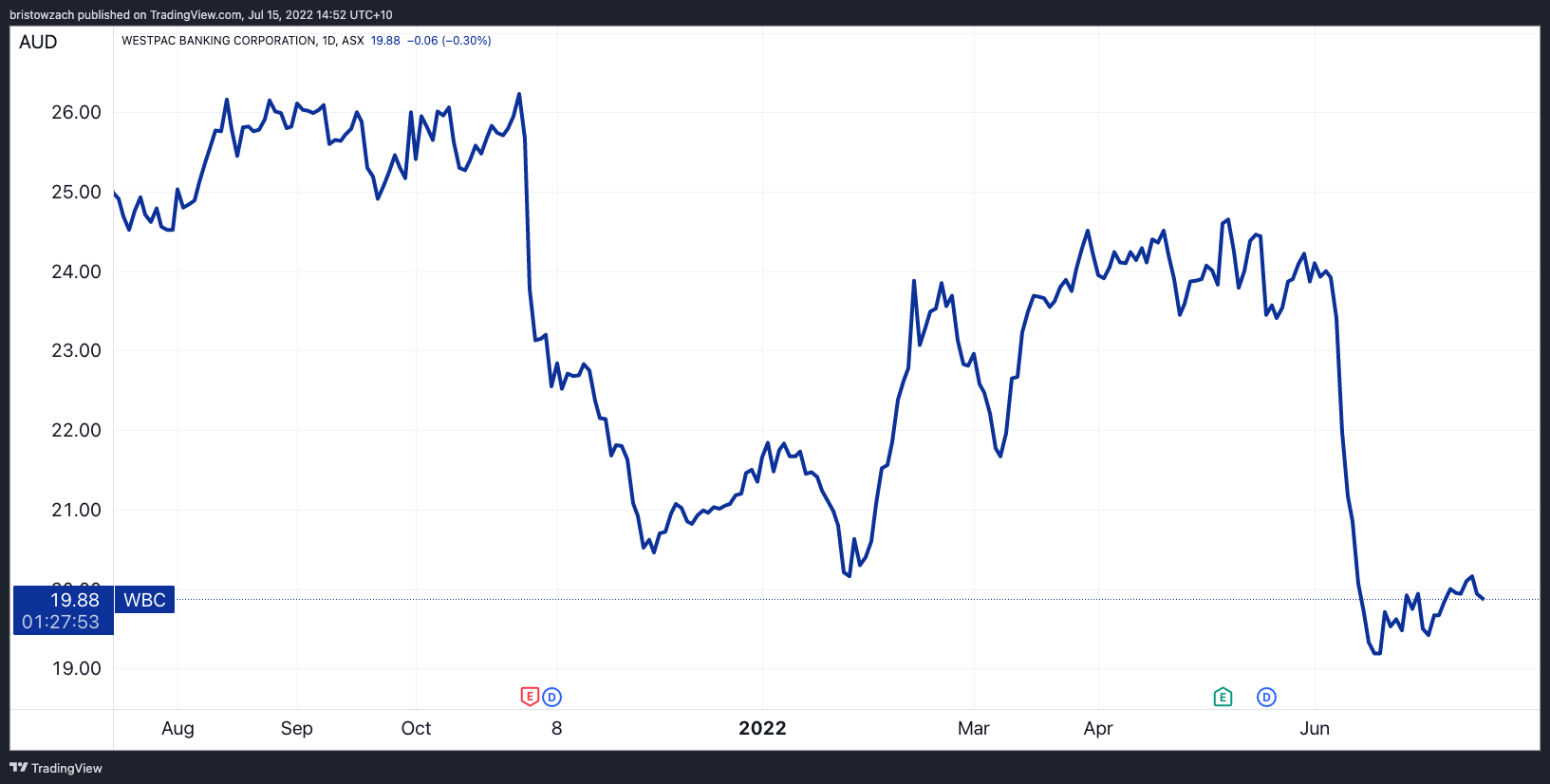

However, the Westpac share price has been on a downward trend for the past 12 months and now rests around 20% in the red over that period (see graph below). It has also fallen 8% so far this year.