This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Tesla (NASDAQ: TSLA) has grown to become the largest producer of electric vehicles (EVs) worldwide. It has always been a trailblazer, leading this new industry with its innovation not just inside each car but also in the manufacturing process.

But 2022 has been challenging. The automotive industry is facing supply chain disruptions that have slowed production, and a brutal sell-off in the stock market has sent company valuations in the tech sector plunging.

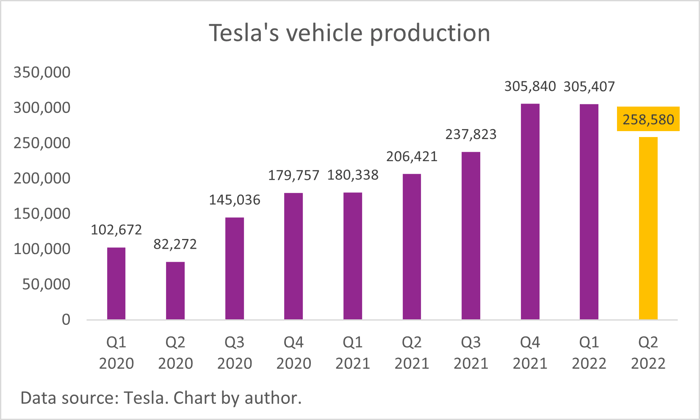

Tesla just reported its production figures for the second quarter of 2022, and it revealed the largest sequential drop in two years. While this is a short-term speed bump, it shouldn't alter the company's long-term trajectory.

Tesla management is navigating tough times

The automotive industry has grappled with shortages of key vehicle components like semiconductors since the pandemic began, as lockdowns across Europe and Asia caused production to grind to a halt. Semiconductors are advanced computer chips that power the digital features inside new cars, but in Tesla's electric vehicles, they do far more.

The infotainment system inside a Tesla is responsible for controlling many of the car's core functions like charging and comfort, in addition to enabling the user to browse the internet and play games. It's a step above the processing power required in a traditional combustion engine car, to the point that semiconductor giant Micron Technology has described electric vehicles as data centers on wheels.

Tesla has navigated the chip shortage well, generating quarterly production growth for most of the past two years. But it was hit with a further challenge when its production facility in Shanghai, China, was shut down for the majority of April as part of COVID-related temporary closings. The facility has an annual manufacturing capacity of 450,000 vehicles, which is almost half of the company's total capacity (until new factories in Texas, Berlin and Germany ramp up), so the downtime heavily impacted second-quarter output.

The slowdown at Tesla might be temporary

When all was said and done, Tesla produced 258,580 vehicles in Q2, which was a 15% drop compared to Q1. But it was still 25% higher than the number of cars produced a year ago, in Q2 2021.

In the commentary that accompanied the Q2 numbers, Tesla informed investors that June was actually its highest production month in the company's history. It suggests two things: The Shanghai plant is nearly back in full swing, and supply chain issues (like chip shortages) are beginning to resolve.

But it's also attributable to the fact that Tesla's two brand new gigafactories in the U.S. and Germany have begun to manufacture vehicles. Once they ramp up to full capacity, it's expected that Tesla could produce 2 million cars every year, which is almost double the number it could make with its existing factories.

That's a sign that the Q2 production slump might be a mere speed bump on the road to much, much higher numbers in the near future. Given Tesla stock is currently down 45% from its all-time high, this might be an opportunity for investors to build a position. For those deploying smaller amounts of capital, keep an eye out for the company's stock split later this year.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.