The Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) share price has been hurting over the last 12 months.

While the Soul Pattinson financial calendar is actually for the 12 months to 31 July 2022, we're going to look at the past year as most individuals and businesses have their financial year-end at 30 June 2022. That makes it an opportune time to review what has happened.

So, what has happened?

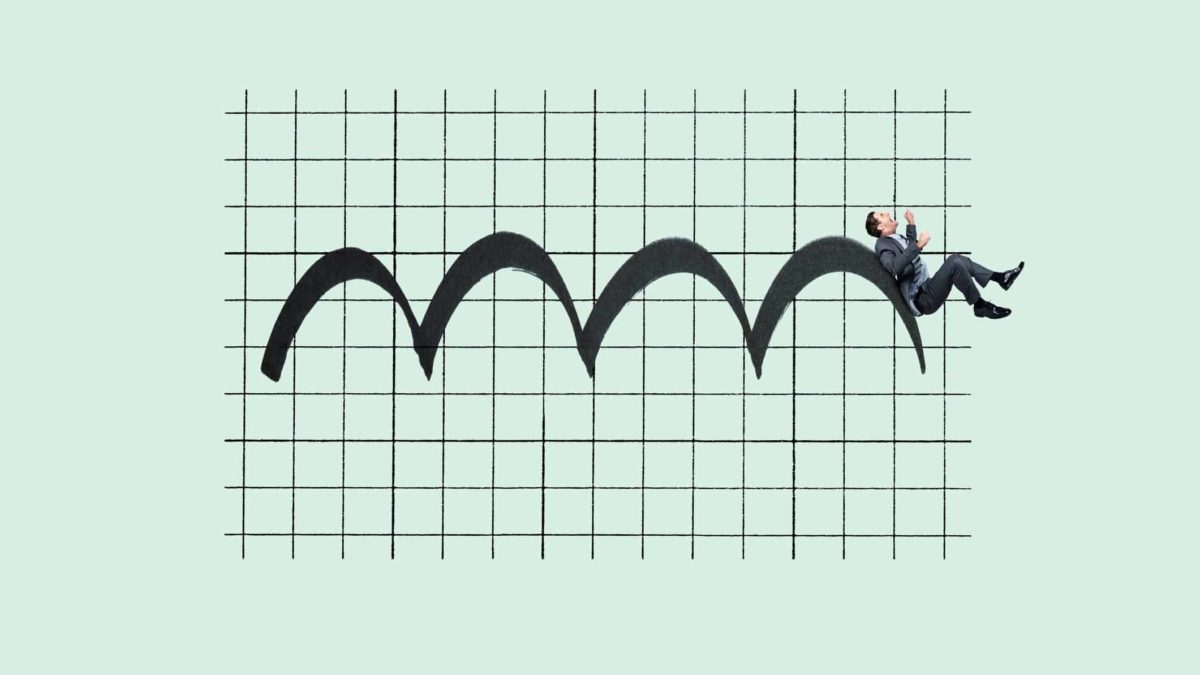

Soul Pattinson share price pain

By mid-September 2021, Soul Pattinson shares had climbed to almost $40. But, they have been on a mostly downward trend since then, dropping around 40%.

As an investment house, a large amount of the underlying value of Soul Pattinson is dictated by the movements in prices of the ASX shares that it owns.

The investment house owns stakes in a number of prominent ASX shares including Brickworks Limited (ASX: BKW), New Hope Corporation Limited (ASX: NHC), Macquarie Group Ltd (ASX: MQG), Commonwealth Bank of Australia (ASX: CBA), and BHP Group Ltd (ASX: BHP). It also holds many more ASX shares and unlisted assets.

Looking at several of these names, there has been volatility and declines for plenty of them, hurting the underlying value of Soul Pattinson. For example, Brickworks, one of the company's biggest holdings, has seen a decline of around 25% over the past 12 months.

Another impact on the Soul Pattinson share price this year may have been the rise of inflation, leading to rising interest rates.

As an ASX dividend share that has grown its dividend every year for the past 20 years, some income-seekers may now be less inclined to go for a 'defensive' ASX share like Soul Pattinson and choose other investments.

Certainly, one of the main highlights for the company was the acquisition of the listed investment company (LIC) Milton.

Milton merger

Soul Pattinson decided to buy the LIC by offering shareholders new shares to the value of 10% of the adjusted net tangible asset (NTA) value of Milton.

The investment house said there were several advantages to the combination. These included greater portfolio diversification, more cash available for future investment into growth asset classes, access to new investment classes including private markets, real assets, credit and international shares, and higher cash generation from increased portfolio dividends.

FY22 half-year result

Aside from Soul Pattinson acquiring 100% of electrical engineering business Ampcontrol, the latest market-sensitive news from the business was its 2022 half-year result.

It said that its group regular profit after tax (NPAT) went up from $90.2 million to $343 million. Net cash flow from investments was $182.6 million, up from $85.million. Excluding the acquisition of Milton, on a like-for-like basis, this cash flow metric increased by 81%.

Soul Pattinson's pre-tax net asset value went up 3.4% for the period, outperforming the "market" by 8.6%.

In March, Soul Pattinson managing director Todd Barlow said:

Valuations across a range of asset classes are becoming more reasonable and we continue to see "strong" opportunities to deploy capital across private equity and structured credit.