This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

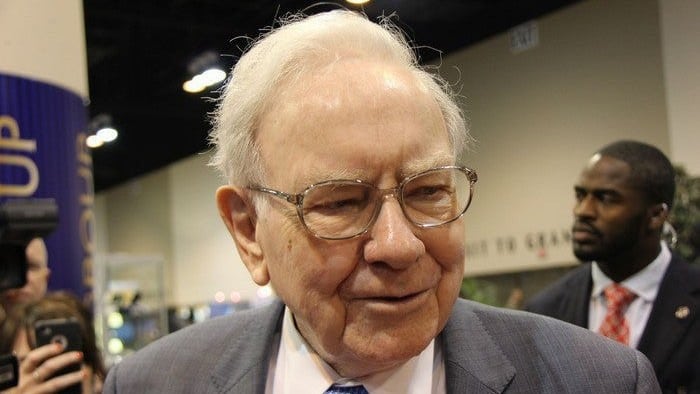

You could say Warren Buffett knows a thing or two about investing. He's been buying equities for decades as Chairman and CEO of Berkshire Hathaway -- a conglomerate worth more than $610 billion. Buffett's personal wealth totals about $100 billion.

Fortunately for the investment community at large, Buffett isn't shy about sharing his investing expertise. While many believe he has a unique gift for seeing business value, some aspects of his strategy are easy enough for novice investors to copy. Here are four of those straightforward investing strategies you can try today.

1. Invest in the S&P 500

In a 2017 interview, Buffett advised retirement savers to invest consistently in a low-cost S&P 500 index fund. In his words, "I think it's the thing that makes the most sense practically all of the time."

S&P 500 index funds invest in S&P 500 stocks. These are the largest and most successful publicly traded companies in the U.S. As a group, they're not going to make you a millionaire overnight -- but they have produced solid growth over time. Historically, the S&P 500 has grown about 7% annually, net of inflation.

S&P 500 index funds are readily available from any brokerage. Some brokerages even support fractional buys on these funds. This is a good option when you're on a tight budget.

Note that Buffett specifically recommends low-cost funds. These are funds with low expense ratios, which represents how much of your invested capital goes toward fund expenses.

An expense ratio of 0.03%, for example, equates to $3 in fees annually for every $10,000 you've invested. The lower the expense ratio, the more of the underlying investment returns flow through to your bottom line.

2. Focus on the long term

You can invest for profits quickly or over time. Buffett follows the latter strategy. He's said his preferred holding period is forever.

Some stocks are better suited than others for long holding periods. Buffett likes established businesses with strong track records through various economic climates -- companies with staying power. Blue-chip companies and S&P 500 stocks generally fit the bill.

On the other hand, trendy stocks, start-ups, and radical innovators are typically outside Buffett's wheelhouse. There are opportunities in these categories, but profit-making can be more dependent on trading vs. holding.

3. Look past market turbulence

Buffett is committed to his long-term approach and doesn't let turbulent markets shake his resolve. When asked for advice on managing through market volatility, Buffett said, "Don't watch the market too closely."

The beauty of long-term investing is that it requires you to do nothing when share prices are falling across the board. Remember that you've invested in companies with staying power. As long as those companies haven't fundamentally changed, waiting is your best move. Keeping your portfolio intact positions you for gains once the down market reverses.

4. Go against the grain

Buffett has famously said his investing goal was to "be fearful when others are greedy and to be greedy only when others are fearful." In other words, be cautious when the market's hot, and look for opportunity when the market's weak.

For Buffett, opportunity often means buying good stocks at lower prices. He did exactly that in the first quarter of 2022 during the big tech sell-off. While other investors were reducing their technology exposure, Buffett picked up 3.7 million shares of Apple, one of his favorite stocks.

Investing like Buffett

Buffett prefers big companies and long, uninterrupted holding periods. He also likes to operate against prevailing market sentiment. While these methods require perseverance, they're straightforward enough for any investor to copy.

Once you implement Buffett's simplest tactics, you can then wait for your gains to emerge over time. In a few decades, you'll remember this day as the moment making money in the stock market got a lot easier.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.