This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

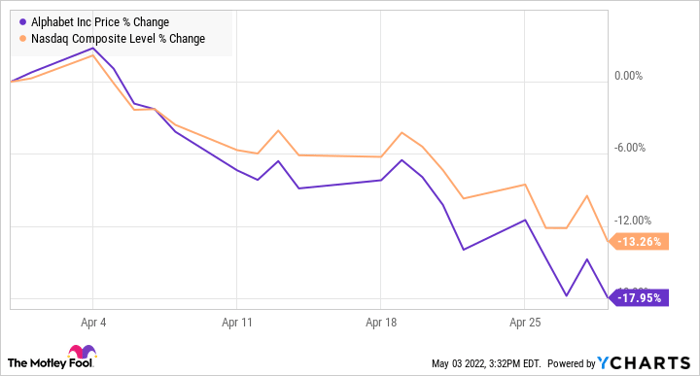

Shares of Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) were getting roughed up last month as the search giant turned in a disappointing first-quarter earnings report and fell alongside the broader tech sector as market sentiment continued to move away from tech stocks. According to data from S&P Global Market Intelligence, the stock finished the month down 18%.

As you can see from the chart below, it was a steady decline for the Google owner over most of April, and the company's descent tracked with the Nasdaq index.

So what

Growth stocks and tech stocks pulled back last month over concerns about rising interest rates, inflation, a potential recession, and the war in Ukraine. Investors also seemed to be adjusting to the end of COVID-19 tailwinds that had favored tech stocks. Although digital advertising, which is Alphabet's main business, is more sensitive to the general business cycle.

The main news out on the stock last month was its Q1 earnings report. It was a solid quarter as revenue increased 23% to $68 billion, matching estimates, but earnings per share (EPS) actually fell from $26.29 to $24.62 as the value of some of its investments declined. That result missed expectations at $25.96.

However, operating income increased 23% to $20.1 billion showing that the underlying profitability of the business remains strong. Growth in search, its core business, was solid, but investors were concerned about a slowdown in YouTube, where revenue rose 14% as some of the pandemic tailwinds faded and the war in Ukraine weighed on the business in Europe. Elsewhere, Google Cloud showed off strong growth but still lost nearly $1 billion on close to $6 billion in revenue.

The stock fell nearly 4% on April 27 after the report came out but recovered those losses the next day as tech stocks soared.

Now what

A number of investors have taken notice of Alphabet's valuation in the wake of the earnings report as the stock is as cheap as it's been in several years, trading for a price-to-earnings (P/E) ratio of just 21, cheaper than slow-growth stalwarts like Coca-Cola or Procter & Gamble.

The reason for that may be more about the broader economy than Alphabet itself, as investors seem to be fearful of a recession especially after US GDP shrunk 1.4% in the first quarter. Spending on advertising is closely correlated with the overall health of the economy and in a recession, Alphabet would likely see a significant slowdown in growth.

However, there's little doubt that it would emerge from a downturn unscathed. Given that, the current price tag and the company's growth rate make it look like a bargain.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.