This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

There's no denying that Amazon (NASDAQ: AMZN) has been one of the market's more rewarding stocks in recent years. Up more than 20,000% since the end of the year 2000, the e-commerce giant has arguably been the market's best large-cap performer for the timeframe in question. It would be easy to be excited about owning it now.

However, past performance is no guarantee of future results. While many investors have high hopes for Amazon stock over the next 10 years, there's no assurance that the world is due a repeat performance. Serious competition is starting to take shape, and the company is closer to market saturation than it was a couple of decades ago.

Still, there are positive signs. While another quintuple-digit surge may not be in the cards, a triple-digit advance by 2032 is hardly out of the question.

It's not the Amazon you know

While the company started as an online book company back in 1995, it didn't take long for Amazon.com to become an "everything store," selling pretty much anything anyone might want to buy when they want to buy it. Counting all of its third-party sellers' inventories, BigCommerce says the company offers at least 350 million products at any given time. No wonder it's seen as the first place many consumers visit to make an online purchase!

In light of its existing reach, there's no reason to think it won't continue growing. BigCommerce adds that nearly 200 million people shop with Amazon every month. Still, there are nearly 8 billion people on the planet, most of whom are not yet regular Amazon customers.

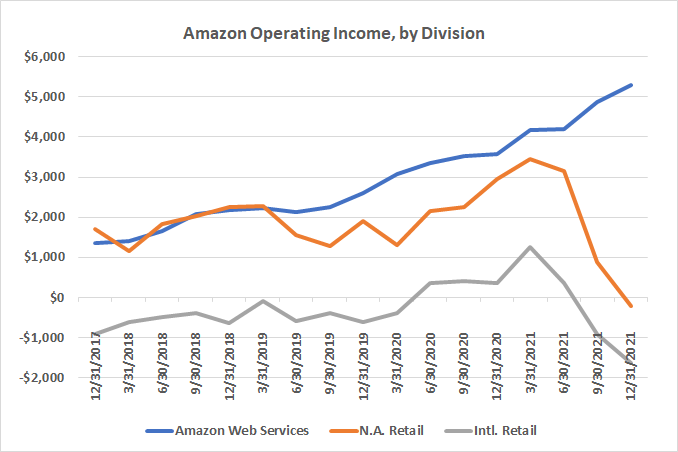

The problem is that the company's consumer-facing online retailing business isn't exactly what you'd call wildly profitable. Here's another interesting fact: It doesn't matter. The graphic below is telling, visually comparing Amazon's operating income for its North American e-commerce arm, its international e-commerce unit, and its cloud computing division Amazon Web Services (AWS).

While at one time the company's online shopping operation carried all the profit weight, since 2018 its cloud computing service's bottom line has been just as important as its North American retailing business. Indeed, since 2019, AWS has been the biggest moneymaker by far, doing more for the bottom line than North America's and its overseas e-commerce efforts combined.

Data source: Amazon Inc. Chart by author. All dollar figures are in millions.

As it turns out, the company's customer acquisition and online shopping expansion is proving very expensive, with inflation only making matters worse. As was already noted, though, it just doesn't matter. Amazon Web Services has become such a monster of a business that it can keep the rest of the company afloat while nascent CEO Andy Jassy works on reshaping the online shopping marketplace into something sustainable.

More of the same profit growth on the way

Yet, Amazon Web Services has only scratched the surface of its potential. Numbers from technology market research outfit Technavio puts things in perspective. Its outlook suggests the worldwide cloud computing industry will grow at an annualized pace of 17% through 2025, ending that period $287 billion bigger than when it started.

Notably, Technavio believes North America alone -- where Amazon has concentrated its cloud computing efforts -- will account for 40% of this growth for a business that's already a major profit engine for the company.

And that's still not all of Amazon's noteworthy growth opportunities outside of conventional e-commerce. While the company has been mostly guarded about providing details of the young business, last year's full-year report confirmed it generated $31.2 billion worth of advertising revenue, monetizing all the traffic its shopping site draws by helping third-party sellers and advertisers steer people to particular products.

While 2021 was a banner year in terms of growth, eMarketer is still calling for at least two more years of double-digit increases for the company's ad business. For perspective, Alphabet's (NASDAQ: GOOGL) (NASDAQ: GOOG) Google generated $43.3 billion worth of search-based advertising sales last year. Bear in mind that this is also high-margin revenue as Amazon is only monetizing a website and traffic it already had, tacking on incremental business.

Millionaire-maker alert

Bottom line? Yes, Amazon is still one of those stocks that could help your portfolio reach the million-dollar mark. But the same investing advice that applied before still applies now, of course. Namely, keep your portfolio diversified and keep your expectations in check.

It's unlikely that Amazon shares will see massive gains again over the coming 10 years since the bulk of the 20,000% return it dished out since the year 2000 was rooted in the fact that Amazon's growth was so unexpected. Investors see it coming now, but they didn't then.

Nevertheless, Amazon certainly has the potential to double or even triple in value throughout the coming decade. The key is simply leaving it alone for that long and letting the stock do its thing.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. The Motley Fool owns and recommends Alphabet (A shares), Amazon, and BigCommerce Holdings, Inc. The Motley Fool recommends Alphabet (C shares). The Motley Fool has a disclosure policy.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.