This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Dividend-paying stocks in the S&P 500 have historically outperformed their non-dividend-paying index peers. Dividend-growing companies in the index have performed even better.

So should we buy the highest-yielding dividend-growth stocks in the S&P 500 and call it a day?

Maybe, but there is one last (and less popular) metric that has historically led to outperformance -- the payout ratio. Specifically, dividend-growing stocks that maintain a payout ratio below 50% help create the exact type of stocked pond people like to fish in, offering investors a healthy balance between returning cash to shareholders and funding company growth.

As a result, it's not the top quintile of highest-yield stocks (and their 74% average payout ratio) that outperform at the highest rate, but the second quintile (and its 41% average payout ratio), according to data from Wellington Management.

Let's find out what this means for investors interested in optimizing their dividend strategy.

High-yield dividends, low growth prospects

While high-yield dividend stocks may be alluring at first glance, many tend to have higher payout ratios. The payout ratio is a stock's dividend payout as a percentage of its net income, and it can quickly tell investors how much of a company's profits are going directly back to shareholders.

When these high-yield stocks continue to increase their dividend payments over time, they eventually begin to test the limits of their financial security, paying out bigger portions of their earnings.

High payout ratios typically mean two things.

First, the company will have less money to reinvest back into the business, spending which could have fueled future sales growth, eventually growing the bottom line. Sales growth is a strong indicator of a stock's long-term performance, putting companies with high payout ratios at a disadvantage thanks to their hampered growth prospects.

Furthermore, if a company has a high payout ratio, its dividend growth potential is similarly restricted -- or worse yet, it may need to cut its payout to maintain financial security. While dividend cuts are far from death knells (sometimes even wise decisions), they generally lead to a sell-off in the stock as income-focused investors flee.

S&P 500 companies that cut their dividend not only underperformed their peers over a 48-year period but produced a negative annual return overall, reinforcing the importance of a well-funded dividend.

Low payout ratios, long-term growth potential

On the flip side, stocks with low payout ratios offer a balanced approach between returning cash to shareholders and funding future growth. Thanks to this extra cash available to reinvest in the business, a flywheel effect can take hold.

First, a portion of the excess profits go back into the business, creating new sales that flow through to the bottom line. With this rising net income, the company can increase its dividend, often without raising its payout ratio as profits and dividends paid out rise at a similar rate.

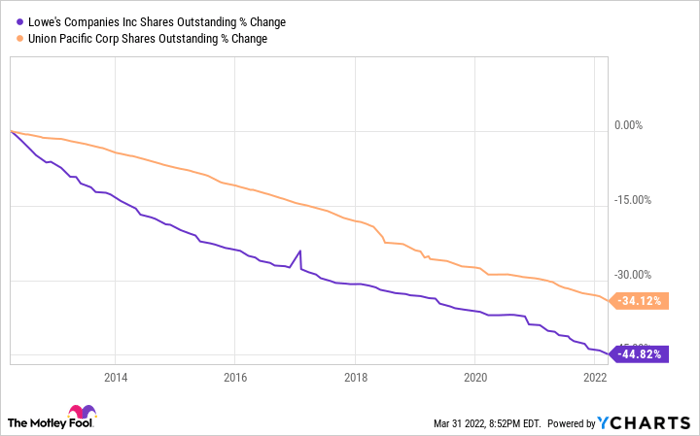

Additionally, if the company still has earnings to spare, management can also consider lowering its share count through share repurchase programs. For example, consider the declining share counts for two great low payout ratio stocks, Lowe's and Union Pacific.

Data by YCharts.

Despite the capital required to maintain their respective operations, these two have not only funded many years of annual dividend increases but rapidly lowered their total shares outstanding over the last decade. Fewer shares make the dividends cheaper to maintain while boosting earnings per share (EPS) -- furthering the flywheel effect.

Because of these benefits, looking for low payout ratios over high yields is akin to choosing longer-term cash flow potential over higher near-term income.

The best of both worlds

Best yet for investors, a handful of stocks offer relatively high dividend yields and low payout ratios. Let's look at three here:

| Metric | Cummins | Intel | Target |

|---|---|---|---|

| Dividend yield | 2.9% | 3.0% | 1.7% |

| Payout ratio | 38.3% | 28.6% | 22.4% |

| Maximum dividend potential | 7.6% | 10.5% | 7.6% |

| Consecutive years of dividend increases | 8 | 19 | 53 |

Source: Yahoo! Finance. Maximum dividend potential = dividend yield/payout ratio.

Notice that despite not having the highest dividend yield, Intel has the highest maximum dividend potential based on its dividend yield divided by its payout ratio. Similarly, Target has a dividend yield about one percentage point lower than Cummins, but they have comparable maximums.

I bring these three companies up to illuminate the power of a low payout ratio. Yes, you may be sacrificing some near-term dividend income by forgoing high-yield stocks, but your long-term dividend potential should one day dwarf that high initial income if you hold for the long haul.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.