This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Amazon (NASDAQ: AMZN) has been in the headlines the past few weeks as the investor community buzzes with news of the company's upcoming 20-for-1 stock split. Stock splits don't change anything fundamental about the company, but they may provide greater access to investing in the stock and make it easier for Amazon employees to manage their equity.

This is the company's fourth stock split since its inception and the first since 1999. While it doesn't change anything about the company outside of having more shares on the market, does it signal a change in its approach to its business? And does this put it on a path to start paying a dividend? Let's take a closer look.

Why do companies pay dividends?

Typically, companies begin to issue dividends when growth slows down and the company is loaded with cash. The standard dividend company has high sales figures but low growth figures, and so paying dividends is a way to provide benefits to shareholders.

Yet, paying a dividend doesn't always mean that a stock price doesn't offer the potential for gains. Very mature companies usually offer a higher yield with fewer opportunities for stock gains, and they often have a high payout ratio -- that's the amount of their cash that they pay out as dividends.

However, there's a huge middle ground where companies pay a dividend with a lower yield and payout ratio. A growing company will usually have its payout ratio around 25%, giving shareholders a cut of its success while retaining most of the cash to plow back into the business and generate growth.

Amazon fits the model of a company whose growth is slowing but that generates tons of cash. So far, it invests its cash back into the company to fund all of its disruptive businesses, such as its recent acquisition of MGM studios and its investment in Rivian Automotive, which it hopes will provide it a fleet of electric vehicles for its delivery services.

Case in point: Apple

Apple is a good stock with which to compare fellow FAANG stock Amazon. While the company did pay a dividend between 1987 and 1995, founder Steve Jobs wasn't a fan of doing so since he felt they offer no intrinsic benefit to the company. And under his leadership, Apple did not pay them out.

But a year after Tim Cook took over the CEO role in 2011, the company began to offer dividends again. Cook felt that paying a dividend would open up the company to new investors, those who actively seek dividend stocks. At the time, Cook said: "Even with ... investments [in our business], we can maintain a war chest for strategic opportunities and have plenty of cash to run our business. So we are going to initiate a dividend and share repurchase program."

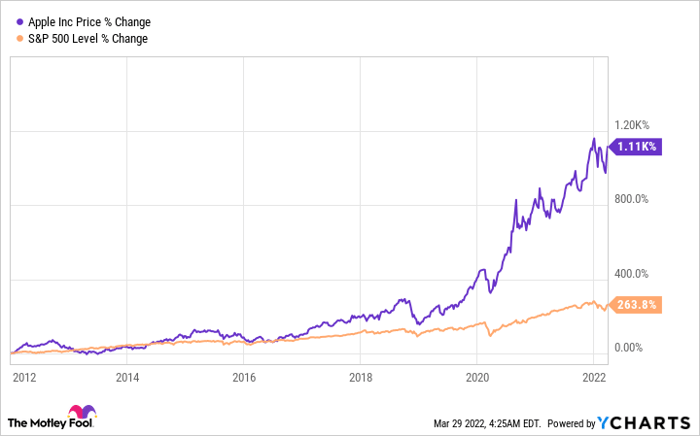

In the past 10 years since Apple started to pay a dividend, its stock has gained more than 1,000%, solidly outperforming the broader market and delivering tremendous value for its shareholders. There was no stock split precipitating the decision to pay a dividend in that case, and the next one was two years later.

There are similarities between where Amazon is now and where Apple was when it began issuing a dividend under Cook. There was a new CEO with a different perspective, and the stock price was at a record high. It had generated tons of cash through high sales, which management decided warranted the dividend, still leaving it with excess cash to invest in growth opportunities.

Are dividend stocks better investments?

In general, dividend stocks tend to outperform other stocks, even though they're not usually high-growth stocks. That might seem counter-intuitive, but the point is that dividend-paying stocks are typically quality businesses that generate a lot of cash. And because they're well-established, they outperform growth stocks as a segment since the category of "growth stocks" includes many initial public offerings that never really get off the ground.

Whereas individual growth stocks may grow many times the price of slower-growing dividend stocks, the risk associated with the sector means your money grows more safely with dividend stocks in addition to the benefit of passive income.

Will Amazon stock become a dividend stock?

Management has said nothing about issuing a dividend, so this is all speculation. In the most recent earnings release, CEO Andy Jassy reiterated that the company is investing in a plethora of growth ventures, from improvements in its core retail segment and other programs to newer initiatives in digital technology and physical storefronts. "There's a lot to look forward to in the months and years ahead," he said.

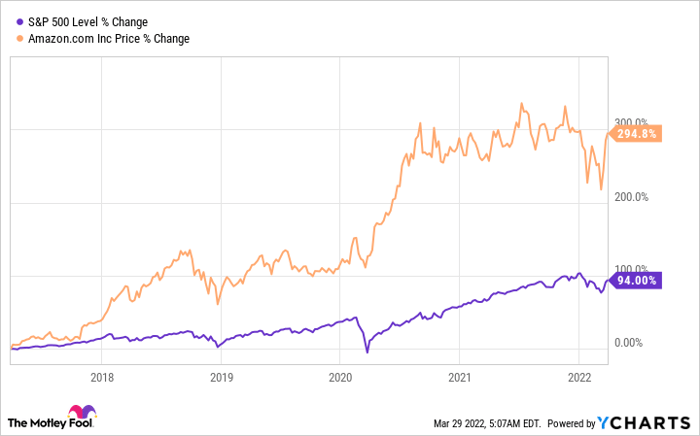

Amazon stock has easily outperformed the S&P 500 over the past five years while it plows money back into increasing its growth.

In the current environment, Amazon is also dealing with cost and wage increases, which are affecting its free cash flow and making the present perhaps not an ideal time to start thinking about a dividend.

In the meantime, Amazon is a great stock to own with plenty of opportunities for growth. There are reasons to consider buying shares before the stock split -- and down the line, in the potentially not-so-distant future, a dividend might be in the cards.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.