One of the most oft repeated investing refrains is: 'trees don't grow to the sky'.

In other words, there's a limit to everything, in terms of how big it can be.

Maybe a 20c stock can go to $1.

Maybe even $5 if you're lucky.

And CSL Limited (ASX: CSL), at $273, has had a good run, but how much much room is there to grow further?

$300? Maybe.

But $400? $500?

That's a lofty old price to pay, even for one of the perennial ASX favourites, right?

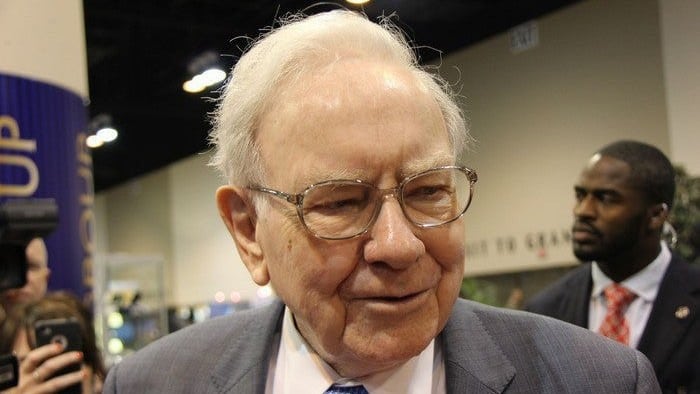

What about a company like Berkshire Hathaway Inc. (NYSE: BRK.A) (NYSE: BRK.B)? (I own shares, for the record).

At $7,100 a pop, that's gotta be as good as it gets, right?

I mean Buffett isn't a young man any more.

True… despite that, Berkshire's an amazing business.

But $7,100 per share?

There must be better options in other parts of the world's stock markets.

I mean, maybe it tops out at $10,000. Maybe – just maybe – it can double to $14,000.

But that's a lot… for one single, solitary share.

Can it really keep growing?

Okay, okay… I jest.

Well, I kinda outright lied.

See, Berkshire shares were $7,100 a pop, not today, but way back in June 1990.

I guess the ride has been pedestrian since then?

Not really. Just under 31 years later, the share price had risen to – and I hope you're sitting down – $382,000.

Each!

(Now, at this point, I need to clear something up. When I say I own shares in Berkshire Hathaway, as I did earlier, I don't own multiple shares at $382,000 each! Given the rising price was putting them out of reach of the individual shareholder, Buffett created a second 'class' of shares, each worth 1/150,000th of a share. It's those 'B Class' shares I own! Now, back to my point…)

That gain — from $7,100 to $382,000 — on Berkshire shares was an astronomical 5,200%.

That'll pay some bills!

Of course, the Doubting Thomas' will now be saying "Okay, okay… but that was then. Surely – this time at last – the show is over!"

A fair question (even if the permabear doom-and-gloomers are, well, a little tiresome).

Except, well, I cheated again.

Not in the numbers — all of the numbers above are spot on.

Even the number of years.

Which, if you re-read what I wrote, takes us up only to early 2021.

So let's stop playing funny buggers, and bring ourselves up to the present day (for real, this time).

In the past year?

Berkshire Hathaway shares are up – you'll need to sit down again – another 32.1%.

They're now selling for $504,036 each.

(That's in US dollars, by the way. Buying one with Aussie dollars would set you back $691,612!.)

The shares that were "obviously" too expensive to go up much more, 12 months ago, went up another $123,000 while we did one trip around the sun.

That's… a lot.

So, a few points here:

1. Just because a company's shares look expensive on a 'price per share' basis, don't believe it.

I could sell a house for $1 million, or I could sell 10 shares in it for $100,000 each, or 100,000 shares for $10 each. Same house. Same total price. The 'per share' price is just a mathematical construct that owes more to the number of shares on issue than anything else.

2. It's true that trees don't grow to the sky. No company can grow at huge compound rates forever. But great businesses can grow more quickly, and for longer, than most people give them credit for.

3. Not for the first time, many investors had written Buffett off. It's a variation on my last point, but when you find quality, don't give it away too quickly or too easily.

4. Speaking of holding on, I hope it didn't escape you that last year's $123,000 gain, per share, was 17 times the price you could have paid in mid-1990. Put another way, in 12 short months, long term Berkshire Hathaway shareholders made 17 times their 1990 price. Imagine buying shares in a company for $10 today, and having them go up $170 per share in 2055… after having gone up 53 times in value in the intervening 32 years!

5. Exciting companies can be, well, exciting. Who doesn't want to own the coolest new thing? Berkshire Hathaway – the insurance and industrial conglomerate run by a nonagenarian – hasn't been cool for a long, long time… if it ever was. I have a sneaking suspicion that three decades of extraordinary compound growth makes up for not being one of the cool kids. That doesn't mean 'cool' can't also be profitable, of course… it just means that you should consider the investment merits of an idea independent of who else is talking about it or excited by it.

And a bonus one:

6. For long periods, Berkshire Hathaway shares went nowhere. Sometimes backwards. It's never a straight, smooth ride, even with the best businesses on the planet. You have to buy, then hold, with conviction, as long as your investment thesis remains intact.

Maybe you're thinking "Okay, but this time, surely, the shares are too expensive".

You might be right.

Or maybe, just as in 1990 and 2021, there is meaningful upside left.

So, instead, here's a mental exercise:

Imagine if every company split or consolidated their shares, so that they all sold for $10 per share, each. (Remember, it's totally possible for any company to do just that – the number of shares is an arbitrary construct).

Now, ask yourself: Which companies deserve a spot in your portfolio, based on their business model, management, competitive advantages, growth potential, and valuation.

If you don't own them already, maybe you should.

And if you own companies that don't make that list… well, you might want to reconsider whether they belong in your portfolio.

Remember, as Warren Buffett himself would remind us, the market is here to serve us, not to inform us.

It's up to us to make the right decisions.

Fool on!