This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It's less than a month into 2022, and already the U.S. stock market is performing differently than in 2021 or 2020. As of market close on Jan. 19, the Vanguard Value exchange-traded fund (ETF) (NYSEMKT: VTV) was down less than 1% for the year, while the S&P 500 was down nearly 5% and the Vanguard Growth ETF (NYSEMKT: VUG) was down over 9%.

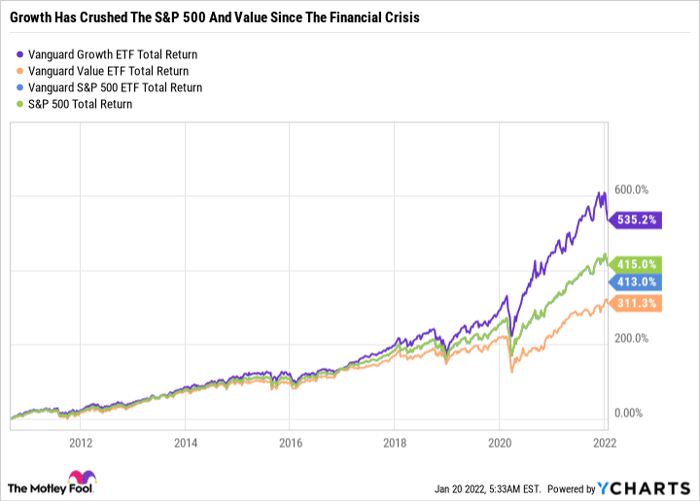

For now, at least, value stocks seem to be replacing growth stocks as the new market outperforming group. To illustrate how rare that is, consider that value outperformed growth just two out of the last 13 years.

Let's determine if now is a good time to rotate out of growth toward value stocks.

1. Determine what kind of investor you want to be

Jumping in and out of what's working in the stock market over the short term is a terrible idea. The last couple of years illustrates this point perfectly.

In 2020, hypergrowth stocks, many of which are unprofitable businesses, propelled the stock market to new heights. Solar and wind stocks also crushed the market, while oil and gas stocks had one of their worst years on record (relative to the S&P 500).

The three worst-performing sectors of the S&P 500 in 2020 -- energy, real estate, and financials -- were the three best-performing sectors in 2021. By the same token, many Cathie Wood-style growth stocks fell over 40% in 2021. Solar and energy stocks drastically underperformed oil and gas last year.

The lesson here isn't just that the market can be irrational over the short term -- it's also that sticking with investments that you like often works out in the end. Those that sold oil and gas stocks in 2020 to buy high-growth stocks in 2021 probably regretted it.

By determining what kind of investor you are and what kind of stocks you like to own, you stand a better chance of eliminating short-term randomness and letting valuations revert to the mean over time. As a bonus, you'll probably be a lot more comfortable. The mental and emotional side of investing often gets overlooked when it comes to financial planning. If you're a value investor who likes dividend stocks and you suddenly find yourself owning mostly growth stocks, you're probably going to be anxious to sell if those stocks go up or desperate to sell if they go down.

VUG Total Return Level data by YCharts

2. Take what the market gives you

After you've determined what kind of investor you are and the companies you like owning, you'll be prepared to buy into weakness and take what the market gives you. Patient investors are in luck because plenty of top-tier growth stocks are down well off their highs right now.

Similarly, value investors had plenty of opportunities throughout 2021 to snatch up shares of top dividend stocks at a steep discount to their current prices.

Most investors probably aren't all-or-nothing when it comes to value, income, or growth. Rather, they probably have a preference but still like some sort of blend of different types of investments.

Timing the market isn't a good idea, but being flexible is. For example, if you missed out on Bitcoin and Ethereum, now is your chance to buy at a better price. If you've been waiting to buy electric vehicle stocks, there are some good buys in that space too.

Keeping some dry powder on the sidelines provides the extra ammo needed to take advantage of dips in great companies.

3. Invest in companies you understand and want to own

One of the worst mistakes I've made as an investor is allocating too high of a percentage of my portfolio toward companies that I don't understand. Peter Lynch, my favorite investor of all time, often joked that people spend so much time dissecting the pros and cons of major purchases like a car or where they are going to live, but are so quick to throw money into a hot investment idea with little underlying knowledge about what they are buying.

Whether we like it or now, fear of missing out (FOMO) is a strong emotion that can inhibit clear thinking and lead to chasing the next hottest growth stock. That's no problem if the stock goes up. But if it falls, let's say by over 50% as many of the hottest stocks in the Nasdaq-100 have done over the past year, then it's harder to know when the bleeding will stop or have the conviction to hold the stock if you don't understand it.

Be wary of a temperamental market

It seems bizarre that many of 2020's hottest industries and companies would turn on a dime and become 2021's biggest losers. On top of that, you could argue that the market went up too far too fast in 2021, given interest rate and inflation risks. The Fed's decision to raise rates wasn't surprising. You would think that an efficient and forward-looking stock market wouldn't be so quick to drive prices down on predictable news. But so far this year, it has.

No one knows what the market will do in the short term or how long one trend will last. Instead of banking on value stocks beating growth stocks in 2022, it's best to stick to positions you like and want to hold for several years, thereby limiting the randomness market fluctuations can inflict on your portfolio.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.