This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

The price of Bitcoin (CRYPTO: BTC) was bouncing back on Tuesday, hovering around $48,700 as of this writing. That's about a 5.1% increase over the past 24 hours, according to CoinDesk. Normal volatility could be the explanation, but there have been some interesting developments over the past 24 hours that could be contributing to today's gains.

So what

Block CEO Jack Dorsey is in the news this morning after saying that Bitcoin will eventually replace the US dollar. The dollar is widely considered to be the world's reserve currency, and many countries have actually dollarized their economies, replacing local currency with American greenbacks. Therefore, saying that Bitcoin can replace the dollar is a bold statement.

However, anyone can make a bold statement, and Dorsey has long been known to be an ardent Bitcoin supporter. It will be interesting to see whether he will be proved correct in the future. But, generally, if demand for Bitcoin continues to grow, the price could increase in future days and months, as it is doing today.

One possible driver for demand could be an exchange-traded fund (ETF) based on the spot price of Bitcoin. On 8 December, WisdomTree Investments submitted amended paperwork to the Securities and Exchange Commission in the hope its WisdomTree Bitcoin Trust can gain approval. If it does, this is one potential catalyst for Bitcoin's price.

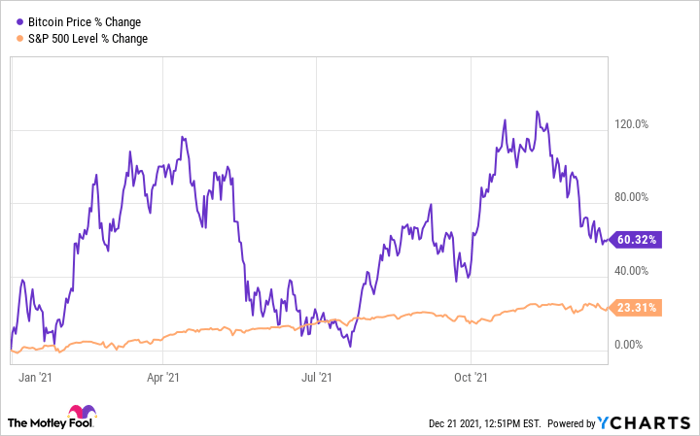

Year-to-date returns for Bitcoin and the S&P 500. Bitcoin price data by YCharts

Now what

As the price of Bitcoin has gone up, some previously dormant Bitcoin wallets have started awakening, making investors wonder what's going on. According to online crypto community Whale Alert, a Bitcoin address with 321 bitcoins just activated after sitting dormant since 2013. That's a relatively small amount of bitcoins, but dormant accounts suddenly coming back to life has been an ongoing trend. It causes some to wonder whether these Bitcoin holders are finally firing up the ol' wallets so they can cash out after record prices in 2021.

Unfortunately, there's a lot of things that investors can't be sure of today. We don't know whether drivers (like ETF approval) will materialize. And we don't know whether these old wallets intend to sell, which would hurt demand. It's a good reminder that there are a lot of moving parts when it comes to cryptocurrencies like Bitcoin, which is why it's healthy to try to see things from both sides before making decisions like investing or selling.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.