This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

There's a right way and a wrong way to handle stock market crashes. Getting the next one wrong might permanently reduce your investment returns. Avoid these three common mistakes if you want to navigate the market cycle like a pro.

1. You shouldn't panic

It's nearly impossible to remove emotion from your financial plan. Who could be completely dispassionate when it comes to their kids' college funds or their retirement nest egg? You've spent years diligently saving and investing for growth, of course you're going to freak out a bit if your assets suddenly tank in value.

However, you have to resist the instinct to panic if you want the best long-term investment outcomes. That's easier said than done, but consider historical market dynamics for some valuable perspective. Volatility is a natural part of equity investing, and market crashes happen. If you're in the market for the long haul, bear markets are unavoidable. Don't blame yourself or your advisor when an event occurs that we should recognize as inevitable.

It might sound grim just to accept periodic severe losses, but there's a good reason for it: Downturns are temporary. Over every 15-year period, starting on any single day in its history, returns for the S&P 500 have been positive. Capital moves in and out of the stock market, but economic growth ultimately spurs the value of companies higher.

Recognize this fact ahead of time, and build your financial plan with this knowledge. When the market is down, remind yourself of this, and look forward to new opportunities that are around the corner.

2. You shouldn't sell your stocks

This one is a lot easier once you've mastered the "don't panic" approach. Selling your stocks in the midst of a market crash might be the worst thing you can do. It's the exact opposite of the buy-low,-sell-high cliché.

You can check the value of your portfolio any given day, but those gains are unrealized until the positions are closed. Open positions are like chips still on the table in a casino -- you're not really a winner until you cash out and leave the building. Obviously, it feels good when your accounts are up, but you have to sell your stocks in exchange for cash in order to purchase something else.

Selling your stocks at a market bottom locks in your losses. Even worse, if you get rid of your stocks and fail to buy back in, you'll miss out on some of the growth when the market inevitably recovers.

The key is understanding your time horizon and personal risk tolerance. If you're still 20 to 30 years away from retirement, your IRA or 401(k)'s exact balance today isn't exactly relevant. You'll go through a few more market cycles before you start making withdrawals. Since you have time to wait for another market recovery, you should prioritize long-term growth.

On the other hand, you shouldn't expose your investments to volatility if you need to liquidate them soon. Retirees, for example, might need to sell their stocks for cash in the next few years. They should build a more balanced asset portfolio to complement Social Security income. Adding bonds or cash will reduce volatility and limit losses. Don't put yourself in a position where you're forced to sell during a crash. Moreover, you'll have extra cash on hand to purchase stocks at lower valuations.

3. You shouldn't be scared of growth stocks

This takes the "don't sell" approach a step further. Market crashes are actually the best times to focus even more on growth, but some scary stock charts will probably cause some trepidation.

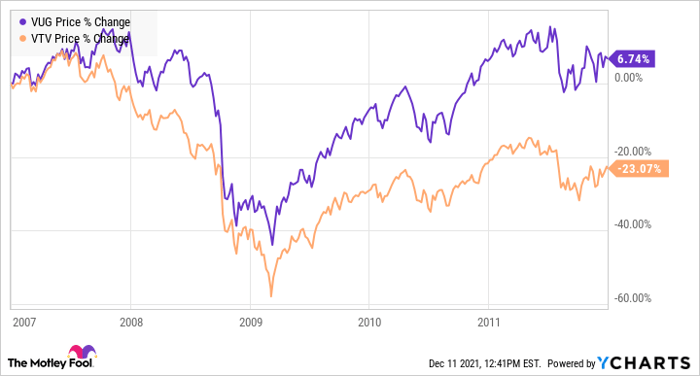

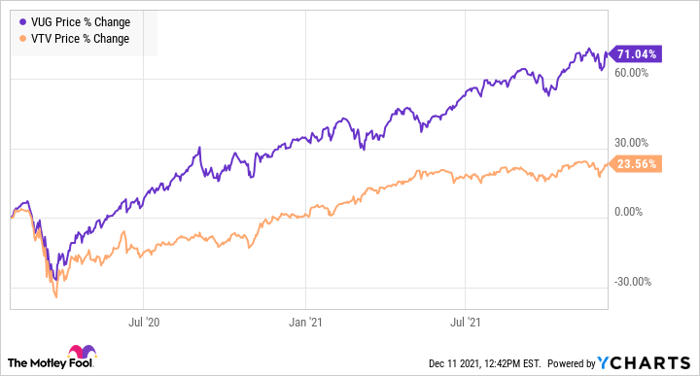

Growth stocks take a pounding during bear markets, so they'll probably have much uglier returns relative to value stocks and the market in general. History can be a valuable guide, but investment returns are built on future results. The stocks that drop the hardest in market crashes tend to be the ones that perform the best in subsequent bull markets.

This becomes clear when we look at the Vanguard Growth ETF's (NYSEMKT: VUG) performance relative to the Vanguard Value ETF (NYSEMKT: VTV) over the last two major collapse-recovery cycles.

Data by YCharts.

The merits of each stock play an important role in returns, but the trend applies, all other things being equal. This isn't to imply that you should be drastically changing your portfolio allocation. Overall, you should come up with a target allocation based on your personal goals and risk tolerance. However, shifts in valuation change the risk/reward profile of stocks over time. When the market crashes, growth stocks will look more favorable, and it's not a bad idea to modestly shift your portfolio to the most aggressive allocation that's acceptable within your personal risk profile.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.