The CSL Limited (ASX: CSL) share price held the fort during November and finished just over 2% in the green for the month.

While it finished relatively flat, the biotech giant's share price nudged past its previous 52-week highs. It closed as high as $318 and traded as low as $300 per share.

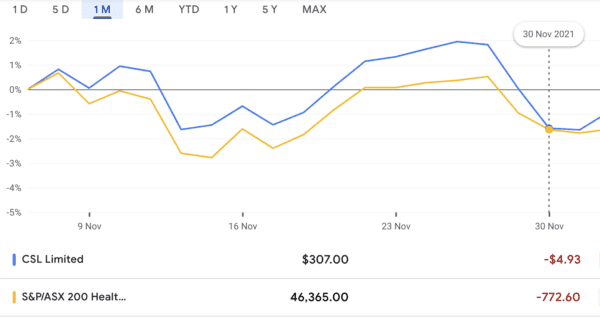

CSL outperforms broad sector in November

The CSL share price outpaced the S&P/ASX 200 Health Care Index (ASX: XHJ) which traded in an almost synchronised fashion to the Aussie biotech's share price over the last month.

Near month's end, the company advised its Seqirus business was granted approval from the US Food and Drug Administration to formulate a multi-dose vial (MDV) version of its Audenz label.

The particular MDV is described as a cell-based influenza vaccine designed to help protect individuals in the event of an influenza pandemic.

Seqirus has a partnership with the Biomedical Advanced Research and Development Authority (BARDA) where it will be positioned to deliver up to 150 million influenza vaccine doses to the US to combat an influenza pandemic within six months. The CSL share price gained on the back of the news.

CSL vs S&P/ASX 200 Health Care Index: November returns in percentages

Source: Google Finance. Google and the Google logo are registered trademarks of Google LLC, used with permission

CSL also recently advised it had secured financing to develop an incubator and wet space lab to support clinical-stage biotechnology startups. The Victorian government is also set to chip in.

In the company's words, incubators break down cost barriers and other barriers to entry for start-ups. Incubators offer a 'one-stop shop' by minimising cost-prohibitive expenditures that otherwise price small biotechs out of the market.

However, the CSL share price struggled on the day the news was announced.

Several investment firms weighed in with their opinion on CSL's outlook during the month as well. Morgan Stanley notes competitor Haemonetics Corporation (NYSE: HAE)'s recent earnings update where it lowered its plasma collection guidance moving forwards.

The firm reckons this could be a challenge to CSL's earnings, particularly with the ever-looming threat of another COVID-19 outbreak that would further diminish plasma donation volumes. Macquarie Group Ltd (ASX: MQG) is more constructive on CSL and values the company at $338 per share.

While it's been a difficult year to date for CSL, it held onto gains earned from the month earlier, where it bounced off a low of $286.19 in line with the broad sector.

The CSL share price is up around 1% in the past 12 months and around 5% this year to date. In the past month, the company's share price has slipped just over 3% and it closed the week down 6%.