The Endeavour Group Ltd (ASX: EDV) share price is inching down today at $6.73, 0.3% lower than its previous closing price.

It's been a rollercoaster ride for Endeavour shares since the company listed around 6 months ago. They have traded as high as $7.36 apiece and as low as $6.07 in that time.

Not only that, but Endeavour has come off a recent high and traded down at speed these past 4 weeks. In that time, shares in the company nudged past the $7.22 mark, before trading sideways and taking a nosedive to roll into December.

What's going on with the Endeavour share price?

Endeavour was spun off from Woolworths Group Ltd (ASX: WOW) and owns prestigious drinks retail brands such as Dan Murphy's and BWS. It also manages around 330 licensed venues around Australia.

Unlike the public, Endeavour isn't immunised against the effects of COVID-19, given its retail and hotels exposure – two of the hardest-hit industries these past 2 years.

The effects of government-enforced lockdowns are carrying on into the back end of 2021 for Endeavour as well. For instance, in its first-quarter trading update, retail sales came in flat whereas sales in its hotels segment dropped by 10%.

Despite the challenges, e-commerce in its retail segment saw growth of 34.4% year-on-year to reflect the changes in consumer behaviour.

Investors responded positively to its trading update, pushing up the Endeavour share price. However, analysts at leading investment banks covering the company aren't so rosy on its outlook.

The team at Credit Suisse reckons Endeavour has been on an extended run, and the company will continue seeing a higher expenditure base in years to come. The firm values Endeavour at $6.10 a share.

Morgans also thinks the Endeavour share price looks frothy at the moment. The broker has slapped a $6.95 price target on the shares which the company nudged underneath in trading today.

What about the macro-economic situation?

Aside from this, the S&P/ASX 300 Retailing Index (AXRTKD) has also been shot down from its previous high in late November, indicating weakness in the broad sector.

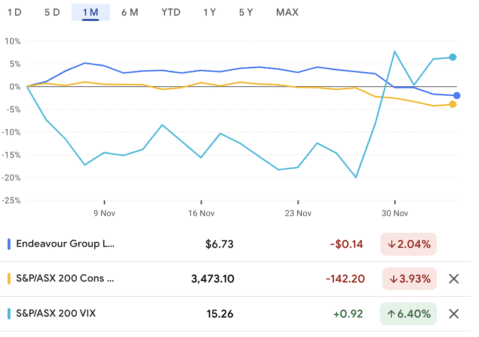

In fact, both have moved in almost synchronised fashion of late – the broad index has slipped 5% since its high on 19 November whereas Endeavour's share price has lagged the index in falling 6.3% in that time.

In addition, the S&P/ASX 200 Consumer Discretionary Index (ASX: XDJ) has also come down by 5% since late November and looks remarkably similar in appearance to Endeavour and the retail index.

It appears investors are still digesting the outcomes of the Omicron COVID-19 variant while evaluating where to budget risk and return. That's according to recent analysis from Goldman Sachs and JP Morgan.

We see this in action when checking the S&P/ASX 200 Volatility Index (ASX: VIX), which gauges market expectations of near-term volatility by looking at the options activity on ASX equity indices.

The VIX is also dubbed the 'fear index' because it tends to rise as investors' fears grow, and falls when investors are feeling more greedy.

For reference, the ASX VIX is up almost 7% in the last month and is up 35% in the last 6 months.

Endeavour share price vs Consumer Discretionary vs ASX VIX – 1 month change

Source: Google Finance. Google and the Google logo are registered trademarks of Google LLC, used with permission

Endeavour shares are down more than 5% in the past week, and investors aren't showing much interest. For instance, today's trading volume is just 29% of its 4-week volume of 3,325,488 shares.