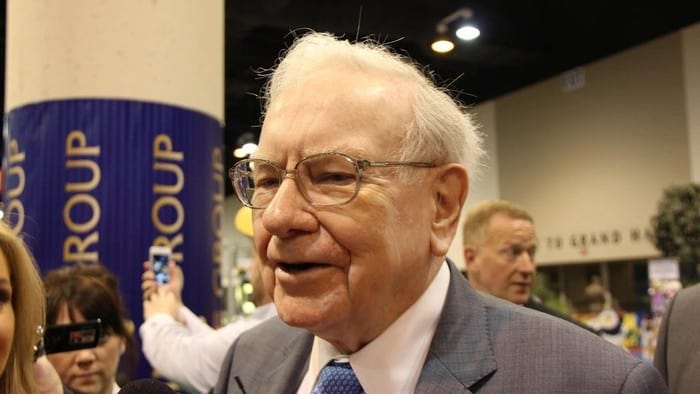

There is a bit of market chatter about the fact that Warren Buffett's Berkshire Hathaway has been a net seller of shares in the latest quarter.

In-fact, according to reporting by Bloomberg, Berkshire Hathaway has been a net seller of shares for the fourth straight quarter. This hasn't been seen since 2008. Could this be a bear market signal?

Berkshire Hathaway ended up selling around US$2 billion more in shares than it bought in the latest quarter. This means that the amount of the cash on the balance sheet has grown to a record of US$149.2 billion.

What has Berkshire Hathaway been selling?

It was reported that the sales seem to have been in the sectors of banks, insurance and financial investments.

In recent times, it has also sold down its position in General Motors Co. as well as some of its pharmaceutical positions.

Has it been looking for opportunities?

Berkshire Hathaway is always on the lookout for potential deals. But the investment conglomerate wants to buy businesses at a good price, which is hard when so many other investment funds, private equity and so on are looking at the same opportunities.

Bloomberg reported that Buffett told investors earlier this year that SPACs (special purpose acquisition companies) were being active in the market, and paying up for acquisitions.

There could also be an issue of how large Berkshire Hathaway has become. Mr Buffett has regularly made the point that Berkshire Hathaway is so large that it needs to be a sizeable acquisition to 'move the needle'. There aren't too many of those sized businesses to choose from. The last time Berkshire Hathaway spent big on a business – US$37 billion for Precision Castparts – it led to a writedown in the value of that investment.

In the absence of acquisition opportunities, Berkshire Hathaway has been buying back its own shares. In the latest quarter, Berkshire Hathaway spent US$7.6 billion on buying back its own shares.

Will Berkshire Hathaway rush into buying something?

Warren Buffett has always said that having patience with investing can be important.

Mr Buffett has previously used a baseball analogy to describe how investors can achieve better returns by waiting for good opportunities. Talking about baseball hitter Ted Williams in HBO's documentary called Becoming Warren Buffett, CNBC quoted Mr Buffett saying:

If he waited for the pitch that was really in his sweet spot, he would bat .400. If he had to swing at something on the lower corner, he would probably bat .235. The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, 'Swing, you bum!,' ignore them.

Another piece of Warren Buffett advice when it comes to timeframes with investing is this:

If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes.

Investors will be interested to see if Berkshire Hathaway's net selling streak continues and if/when Warren Buffett decides to unleash that large pile of cash on potential opportunities.