The Fortescue Metals Group Ltd (ASX: FMG) share price retested September lows on Tuesday, briefly hitting a 16-month low of $13.97.

Iron ore has cratered amid pressures from all angles. From a demand perspective, factors like China's energy shortage, Evergrande's debt crisis and a reduction of steel output have dampened demand. While on the supply side, global iron ore production is forecast to accelerate in the coming years.

With the Fortescue share price going down as fast as it went up, what should investors expect next from iron ore?

Office of the Chief Economist: What's next for iron ore?

The Australian government's commodity forecaster, the Office of the Chief Economist (OCE) provides quarterly updates, forecasting the value, volume and price of Australia's major resources and energy commodity exports.

Its latest September quarterly report was released this week.

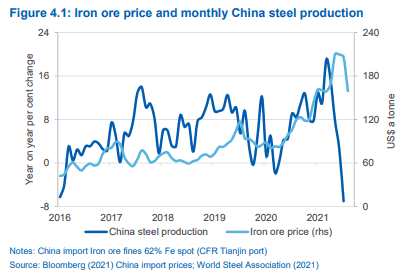

The report cited China's softening demand for steel triggering major falls in the price of iron ore.

This was, in part, due to the seasonality of China's demand for steel. Demand is typically stronger in the first half of each year as spring construction gets underway. Steel output tends to plateau from around May onwards, coinciding with the start of the rainy seasons.

However, the report observed the seasonal fall in production in 2021 was far greater than in recent years.

China's fading infrastructure investment, efforts to deleverage the significant levels of debt in its economy and weak construction sector greatly exacerbated the fall in demand.

Adding to iron ore woes was China's commitment to curbing steel production from the September quarter as part of its goal to lower national steel output in 2021.

China' steel output accelerated 12% year-on-year in the first six months to June, meaning a significant decline was needed in the second half in order to meet its targets.

The report said that domestic demand for steel has eased in recent months but now "appear[s] to be taking greater effect at a national level".

It warned that these effects will persist in the second half of the year following "mandated nationwide steel production cuts from June, and local enforcement of this measure".

As such, the OCE forecasts that these policies are expected to "have an ongoing dampening effect" on iron ore demand and prices through to 2022.

Supply factors could also work against iron ore prices after the OCE flagged that the world's largest iron ore producer, Brazil's Vale, is "slowly returning to output levels last seen prior to the January 2019 Brumadinho tailings dam collapse".

Furthermore, Australian export volumes are forecast to rise in the second half of 2021.

The OCE forecasts iron ore to average around US$150 a tonne in 2021 before falling to below US$100 a tonne in 2022.

Fortescue share price snapshot

The Fortescue share price is deep in the red for 2021, down 42% year-to-date.

At their highest point in the last 12 months, Fortescue shares were up around 53%. These gains have now disappeared with the share price down 15% since October last year.