Well, the AMP Ltd (ASX: AMP) share price has done it again. AMP shares are today finding yet another new all-time low. This embattled wealth manager is currently trading at a share price of just 96 cents a share, down 3.33% today. Last week, we covered how AMP had sunk below $1 a share for the first time ever in its 20-year-plus history of being an ASX company.

Well, today that dubious record has been extended. The current AMP share price of 96 cents a share is indeed the lowest AMP shares have ever traded at.

But, unfortunately, this is just the latest move for a company that has been sliding in value for years now. AMP last reached an all-time high way back in 2002, just a few years after it demutualised and IPOed on the ASX boards. Back in 2002, AMP reached a share price of close to $14 a share, which investors may find difficult to comprehend today.

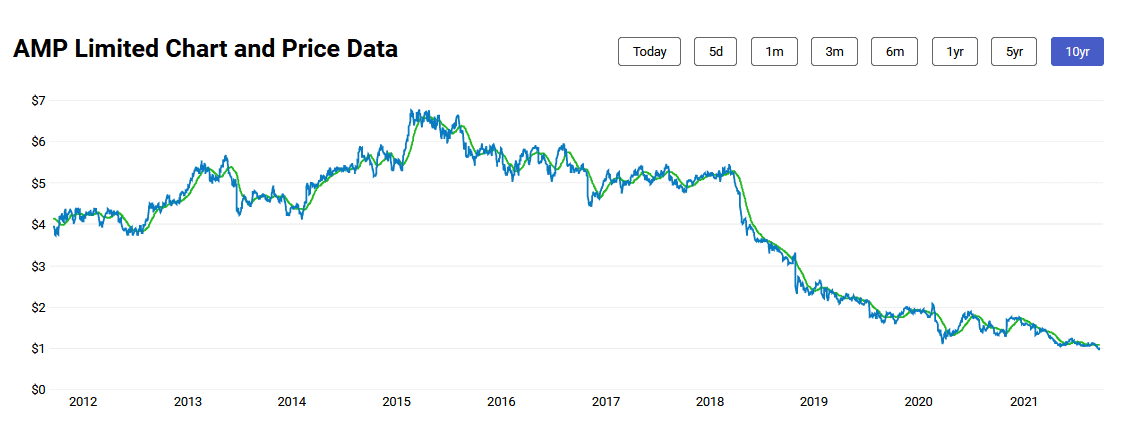

But AMP shares have been on a slow but steady decline ever since. Just take a look at this share price graph for the past decade, and you'll (literally) get the picture:

Not a pretty picture for investors. AMP shares are now down more than 38% year to date, as well as by more than 82% over the past 5 years.

So what has gone so wrong for the AMP share price?

Well, it's most recent woes all start with the 2018 Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. This Royal Commission uncovered systemic failures and rorts at a number of ASX financial institutions.

But AMP was one of the companies singled out for some pretty awful alleged conduct. Including the infamous 'fees for no service' scandal. The report's findings prompted a mass exodus in AMP's leadership at the time, with the company bringing in new CEO Francesco de Ferrari.

However, de Ferrari's tenure as AMP CEO failed to result in a meaningful turnaround for the company's battered reputation, even though he successfully managed AMP's sale of its life insurance business. Ferrari resigned from his CEO position earlier this year, and was replaced by Alexis George last month.

In saying that, the company did release an initially well-received FY21 earnings report last month. AMP reported a 57% increase in net profits after tax, as well as an 8% bump in funds under management.

As it stands today, shareholders are waiting to see how AMP's planned spin-off of AMP Capital Private Markets, scheduled for the first half of FY2022, fares.

But we can't deny that today's new low for AMP is depressing news for shareholders. Many will have their fingers crossed that the next few years will turn out better than the last few.

At the current AMP share price, the company has a market capitalisation of $3.13 billion.