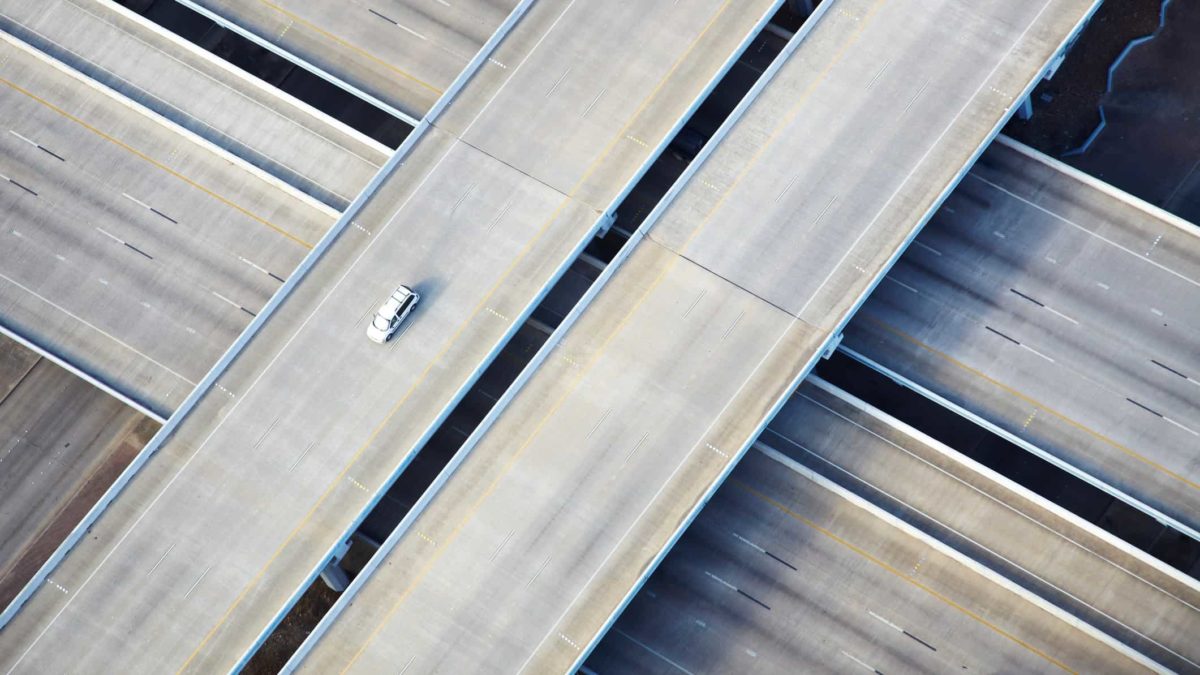

Investors may finally have a reason to get excited again about the Transurban Group (ASX: TCL) share price.

There are reports that the ASX toll road operator is in pole position to snatch a commanding stake in Sydney's WestConnex.

This is because its biggest competitor to the buyout, IFM Investors, is pulling out of the race, reported the Australian Financial Review.

Transurban share price in fast lane to WestConnex?

The article didn't cite any sources but claimed that IFM will not be bidding on the auction this week. This is despite undertaking due diligence over the past six months and trying hard to win a slice of the asset over the last five years.

If the rumours are true, it could energise the Transurban share price. There has been a lack of catalysts for the S&P/ASX 200 Index shares as the long delta lockdowns in Victoria and New South Wales and project blowouts cloud its outlook.

Transaction share price catalyst

Nothing like a significant transaction to put the Transurban share price back in the fast lane!

IFM taking the exit ramp means leaves a clear road ahead for Transurban and its consortium buddies to put in a winning bid for 24.5% of WestConnex this week.

The consortium includes AustralianSuper and Canada Pension Plan Investment Board, according to the AFR.

In it to win it

Another 24.5% stake in WestConnex will be auctioned off next week. But bidders will need to have participated in the first auction to be entitled to bid in the second. As they say, you have to be in it to win it.

But the last lap is usually the most exciting part of any race, and this is no different. IFM has not formally withdrawn from the auction and there's room for manoeuvring and surprises before Thursday's bid deadline.

After all, IFM lost out to Transurban for a stake in WestConnex back in 2018 and one would think they wouldn't be giving up so easily.

Infrastructure makes hot M&A targets

Throw in the fact that quality infrastructure is in hot demand during this ultra-low interest rate era. It's this hunt for stable and predictable yield that triggered takeover bids for the Sydney Airport Holdings Pty Ltd (ASX: SYD) share price and Spark Infrastructure Group (ASX: SKI) share price.

There's even talk that gas pipeline owner APA Group (ASX: APA) could attract a suitor too even as it mulls acquiring assets.

Too early to call a winner

Further, IFM will miss out on a $50 million consolation prize if it pulls out now. The AFR said that bidders are offered a 1% capital commitment fee if their bid hit the states reserve price and was unsuccessful.

The fee is meant to offset costs in preparing the bid and to encourage competition.

In case you are wondering, Transurban and its consortium owns the 51% stake in WestConnex that isn't up for auction.