The Medibank Private Ltd (ASX: MPL) share price has climbed well into the green over the past few weeks.

Whereas the S&P/ASX 200 Index (ASX: XJO) is down 0.13% over the last month, Medibank shares have gained a further 7% over this time.

Let's uncover what's behind these gains.

What tailwinds are behind the Medibank share price?

The Medibank share price has been on a strong run over the last month. Although, there hasn't really been a great deal of market-sensitive information during this time.

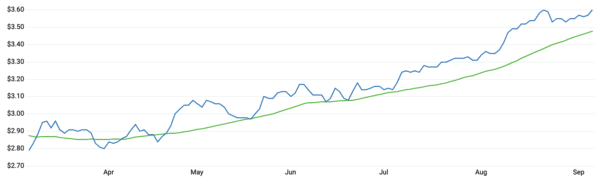

However, looking at the chart, Medibank shares have been trading in an ascending channel since March this year, climbing 20% this year to date.

Medibank Private share price, long-term trend: March-September 6 2021

Source: The Motley Fool

This momentum has been carried through the month of August until today and seems to be fuelled by several drivers in the company's growth engine.

For starters, Medibank completed the acquisition of Myhealth Medical Group back in February. Then it released its half-year results for FY21 where it recognised a 27% increase in net profit after tax (NPAT) from the year prior.

In June, Medibank then announced it would return approximately $105 million to customers impacted by COVID-19. As per the company, the payment would cover around 2 million accounts.

As such, the company's total COVID-19 support package amounted to $300 million.

Finally, the company released its FY21 results in August, recognising stellar growth over the year.

In its report, Medibank recognised a 40% jump in NPAT to $441 million that stemmed from a 4,900% increase in net investment income.

Consequently, the company increased its full-year dividend to 12.7 cents per share, a year on year increase of around 6%. Shareholders will enjoy this payment with full franking credits.

Based on the sum of these factors, it appears the Medibank share price has climbed higher over the last four weeks as a part of a long-term upward trend that has been sustained over 2021.

From this long-term trend, the Medibank share price is trading near its five year high of $3.67, currently sitting at $3.61 which is up 0.28% on Monday's closing price.

Medibank Private share price snapshot

The Medibank share price has climbed 42% over the past 12 months after a bumpy start to 2021. In the past week, Medibank shares have walked a further 1.4% into the green.

This return has outpaced the broad index's gain of around 25% over the past year.