The Australia and New Zealand Banking Group Ltd (ASX: ANZ) share price has had a rather interesting start to the trading week this Monday. At the time of writing, ANZ shares are currently up 0.07% to $28.33 a share after initially falling in the early hours of today's trading session.

But let's check out how the ANZ share price has performed over the month of August so far.

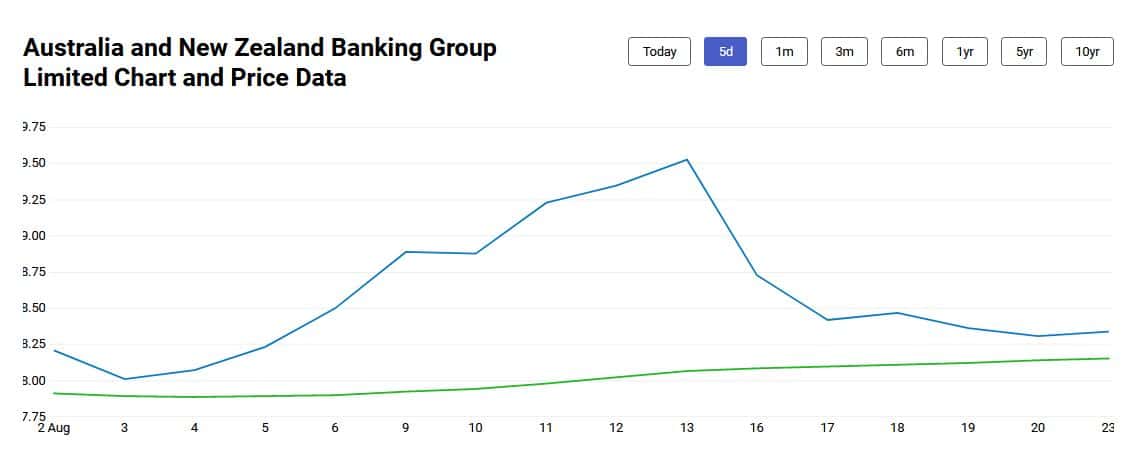

Here's a share price graph of ANZ since the start of the month to kick things off:

Measuring from the start of the month to today, we can see that ANZ shares have gone from approximately $27.70 a share to $28.35 today. That's a rise of 2.35%. Not a bad return for 3 weeks or so of waiting.

But the journey is a little more complicated than that. You can see a large swell in ANZ shares earlier in the month that peaked around Friday 13 August (not so unlucky for ANZ it seems). That marked the time ANZ hit its latest 52-week high of $29.64 a share. The bank is still down around 4% from that high today.

What has moved the ANZ share price in August so far?

As my Fool colleague Nikhil covered at the time, this peak coincided with the release of Commonwealth Bank of Australia's (ASX: CBA) full-year earnings release. This release, which announced a big dividend bump and a $6 billion share buyback program, seemed to light a rocket under the entire ASX banking sector.

Another factor that may have been assisting ANZ was the appointment of Farhan Faruqui as ANZ's new chief financial officer earlier in the month. As we covered at the time, the appointment of Faruqi, currently an international executive at the bank, seemed to be well-received by investors.

But the sugar hit from these two events was short lived. As we flagged earlier, ANZ shares have been falling away from their new highs ever since.

Where to now for this ASX banking share?

So now that the ANZ share price has fallen back to earth, where might it go next? Well, one broker who has an idea is investment bank, Goldman Sachs. Goldman currently rates ANZ shares as a buy, with a 12-month share price target of $20.74 a share. That implies a potential 12-month upside of almost 8.5%, not including dividends.

Goldman reckons ANZ shares are being supported by the company's net interest margins right now. As well as its low valuation compared to its peers. It also sees ANZ benefitting from productivity gains in the years ahead.

At the current ANZ share price, this bank has a market capitalisation of $80.6 billion. It also has a price-to-earnings (P/E) ratio of 17.2, and a trailing dividend yield of 3.7%.