The Qantas Airways Limited (ASX: QAN) share price has not been one that has enjoyed 2021 so far. At the time of writing, Qantas shares remain down by around 13% year to date.

With the airline scheduled to report its FY2021 earnings next Thursday, it might be a good time to jump into the Qantas share price history to see if we can learn anything today.

Qantas is a company that many investors might feel a special attachment to. The 'flying kangaroo' used to be a government-owned company before its privatisation back in the 1990s. Today, it is listed on the ASX boards as a public company, available for all Aussie investors.

What does the Qantas share price flight path look like?

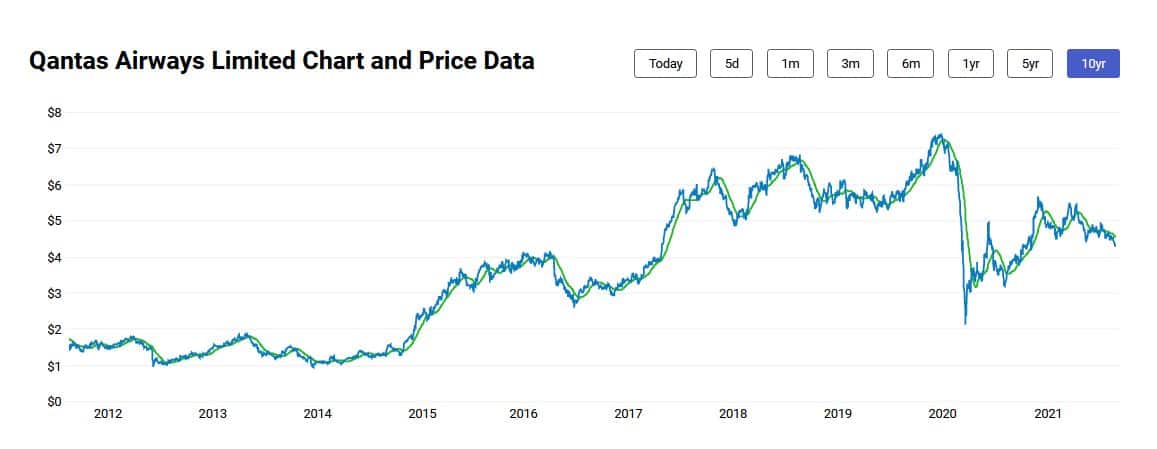

Well, to start things off, here is a graph of Qantas share price over the past decade:

As you can see, it hasn't exactly been a smooth ascent over the past 10 years. As an airline, Qantas is a company that faces wildly cyclical business conditions. Its profitability rests on many factors, including oil prices, competition, Australian dollar exchange rates, demand for tourism and travel, and the overall health of the economy.

You can see this cyclicality reflected in the Qantas share price.

Of course, the biggest hit that Qantas has taken in the past decade came last year with the onset of the coronavirus.

As soon as it became evident that both international and domestic travel would be shuttered last year, the Qantas share price went into freefall. In December 2020, Qantas shares were at an all-time high, over $7. But by late March 2020, the company had fallen to less than $2.50 a share.

Qantas shares have faced a lot of turbulence (last pun, I promise) in the months since too. With lockdowns, international 'bubbles' and travel restrictions whipsawing wildly from state to state, and country to country, over the past 18 months or so, Qantas has certainly had to endure plenty of uncertainty.

The more recent Delta outbreaks have clearly not been helpful to the company. Qantas shares are now down more than 13% since the start of July.

So it will be interesting to hear what the flying kangaroo has to say next Thursday when it reports its earnings.

At recent Qantas share pricing, the airline has a market capitalisation of $8.19 billion.