Aussie tech-preneurs from Afterpay Ltd (ASX: APT) and Atlassian have united to lead the push for Australia to become an irresistible hub for tech startups.

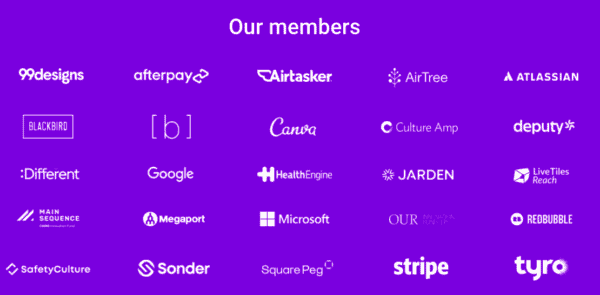

And the Australian-founded companies are not alone in their ambitious goal. Joining them is an all-star alliance comprising 24 iconic technology leaders, forming the Tech Council of Australia (TCA) on Wednesday.

The news arrives a week after ASX-listed Afterpay revealed its receipt of a $39 billion takeover offer from Square.

Putting Australian tech on the map

The formation of the TCA is a big step for the Australian technology sector.

Specifically, the Council is made up of 24 tech companies, including Google, Canva, Microsoft, Afterpay, and Atlassian. Its focus is to boost the growth of Australia's tech sector, support talent attraction and development, and work with regulators for a "tech-enabled economy".

Among other goals, the Council is emboldened to drive the sector above one million jobs by 2025. To do this, the team of tech titans aims to make Australia an irresistible location for tech startups to find their feet and flourish.

When it comes to the board of the TCA, it is certainly an impressive lineup. The Chair overseeing it is none other than Robyn Denholm. In addition to her newfound role with the TCA, Denholm is at the helm of illustrious electric vehicle maker Tesla.

Joining Denholm is Afterpay CEO Anthony Eisen, Atlassian co-CEO Scott Farquhar, :Different co-Founder Mina Radhakrishnan, and Canva co-Founder Cliff Obrecht, among others.

Technology is integral to Australian economy

The announcement of the newly formed tech body arrives with a fresh report into the industry from Accenture.

In a tweet this morning, Atlassian co-Founder Mike Cannon-Brookes outlined a few notable findings. These included:

- Technology is currently the third highest contributor to Australia's gross domestic product (GDP), amounting to $167 billion.

- One in 16 Aussies work in the tech sector, making it Australia's seventh largest employer.

- Australia is third among OECD countries for businesses employing ICT specialists.

Furthermore, the report suggested that Australia is undergoing an economic shift not too dissimilar to globalisation. Putting that into context, software and app programmers are now more common than plumbers, hairdressers, or secondary school teachers.

Denholm explained that Australia is already showing signs of its potential tech prosperity, stating:

We now have many ambitious founders in Australia too, who have been very successful and, for me, that's a really important part of creating that multiple generational industry, that you can start small and take on big audacious goals.

Afterpay as an example on the ASX

The Aussie buy now, pay later player is an iconic example of the booming technology space arising on home shores. Starting out in 2014 as an idea of co-Founders Nick Molnar and Anthony Eisen, Afterpay has gone from a small-cap to a $39 billion valuation in the space of 5 years.

In an interview with The Australian, Eisen relayed his take on the Aussie mission, stating:

It would be fair to say that a lot of people on the committee have seen first-hand what it's like to just have exceptionally talented people in Australia just work their guts out to have a place in the global scale. And it's really reflective of what Australian culture is all about. So being able to give that impetus and direction and momentum is entirely where everybody's coming from. Because the opportunities are very significant if you can capture it and everyone can get behind it.

Finally, at the time of writing, the Afterpay share price is fetching $133.39 on the ASX, down 0.66%.