The Vanguard Australian Shares Index ETF (ASX: VAS) has a rather special place in the eyes of Australian investors, if the data is anything to go by. As we've covered on the Fool before, VAS is the ASX exchange-traded fund (ETF) that is the most popular amongst Australian investors.

As it stands today, this ETF has approximately $8.8 billion in funds under management (FUM), more than any other ASX ETF.

If you didn't know, VAS is an index fund. It covers the largest 300 companies on the ASX by market capitalisation, tracking the S&P/ASX 300 Index (INDEXASX: XKO).

This includes everything from Woolworths Group Ltd (ASX: WOW), Telstra Corporation Ltd (ASX: TLS) and Commonwealth Bank of Australia (ASX: CBA) to Afterpay Ltd (ASX: APT), JB Hi-F Ltd (ASX: JBH) and Ampol Ltd (ASX: ALD).

But what is the share price history of VAS? What have been its biggest ebbs and flows over the past decade? Well, to answer that question, let's first go through this ETF's performance figures.

What is the VAS ETF's past performance like?

So over the past 12 months (as of 31 July), VAS has returned a very healthy 29.11%. Over the past 3 years on average, VAS has returned 9.7% per annum.

It's very similar over the past 5 and 20 years, where VAS has returned an average of 10.08% per annum and 9.75% per annum respectively. These numbers include the impact of dividend returns as well which, considering VAS is a market-wide ASX ETF, are substantial.

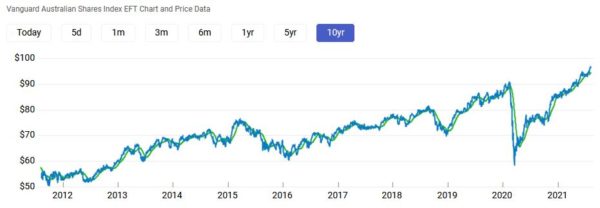

But let's put this all in some visual context. Here is a graph of this ETF's performance over the past 10 years:

As you can see, there have been a few bumps and bruises over the past 10 years, but overall it has been a story of appreciation.

The largest dip occurred last year, during the coronavirus-induced share market crash which hit global markets in February and March 2020. Peak to trough, VAS lost approximately 32% of its value between 20 February and 20 March 2020.

But we all know how that ended up playing out. From late March onwards, the Australian share market staged a remarkable recovery, which of course was also captured by this ETF. Between March 2020 and today, VAS has appreciated by roughly 57%.

Before 2020, we saw some far more minor bumps and dips. The malaise that the markets went through back in 2015 is plain to see here, as is the short-but-sharp dip the markets experienced in late 2018.

Perhaps what is most evident though is how the more one zooms out, the less these dips seem to matter.