The Macquarie Group Ltd (ASX: MQG) share price has been a major performer on the ASX and delivered outsized returns over the past decade.

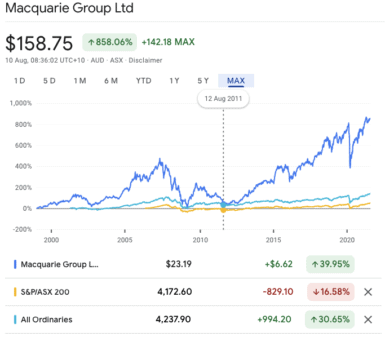

Whereas the S&P/ASX 200 Index (ASX: XJO) has climbed around 80% over the last 10 years, Macquarie shareholders have enjoyed far healthier returns over this same time.

We've done the math to illustrate how the Macquarie share price has performed over the past decade.

Investing with a long-term horizon

Investment bank Macquarie Group first listed on the ASX in 2007, and since this time, its shares have exhibited significant capital appreciation.

Imagine if, 10 years ago, we were a prudent investor and allocated $1,000 to purchasing Macquarie shares at the closing price of $23.19 on 12 August 2011. That's about 43 shares on our book.

Macquarie share price vs ASX broad indexes

Source: Google Finance

The first way we need to consider our return is to calculate our capital gains over that time period. In doing so we realise a return on our initial investment of 584%, well above each of the broad indexes' returns.

That implies our original position is now worth $5,840. However, that ignores one half of the equation. We need to factor in the impact of Macquarie's dividend, to capture our total return.

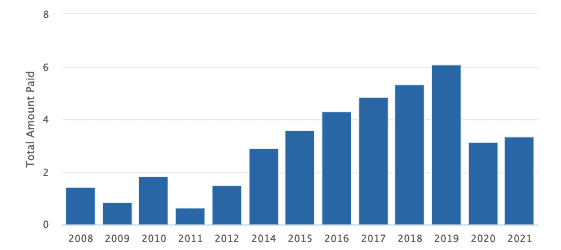

The impact of Macquarie's dividend

Over the course of our examination period, Macquarie has returned $35.75 per share to shareholders by way of dividend payments.

Macquarie has grown its dividend at a compound annual growth rate (CAGR) of 17.8% since 2011. Prior to the haircut of 2020, it had grown dividends at a CAGR of around 25%.

Macquarie dividend schedule, 2008 – 2021 (current)

Source: The Motley Fool Australia

Therefore, factoring in Macquarie's dividend schedule, our total return balloons to more than 738%. Consequently, this implies our position is worth $7,380.

Moreover, some very interesting outcomes occur when we make some minor tweaks to our calculations. Let's assume we reinvested each of the dividends received over the previous decade, to buy more Macquarie shares.

Drawing on the power of this dividend reinvestment plan (DRIP) we yield a total return of 1,091% on our original investment. That implies our position is now worth $10,910.

As such, our prudence in maintaining a long-term horizon in our investment reasoning paid off in this hypothetical scenario.

Foolish takeaway

This case example suggests that long-term investing can potentially pay off if done correctly.

A DRIP is an interesting way to harness the power of compounding, which has been dubbed the "8th wonder of the world".

Macquarie shareholders have enjoyed a return that has significantly outpaced both broad indexes over the past decade.