This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Alphabet (NASDAQ: GOOG), (NASDAQ: GOOGL), otherwise known as Google, is one of the largest companies in the world by market cap. Shares of the tech giant are up over 5,000% since its IPO in 2004, and the company now has a market cap of $1.8 trillion. But if its latest results are any indication, the company is showing no signs of slowing down. Here are five reasons investors might still be underestimating Alphabet.

Google Services margin expansion

In its latest quarter (second quarter of 2021), Google Services, which houses all search, advertising, and premium consumer products, did $57 billion in revenue. This was up 63.1% from the second quarter of 2020. 2020 was an easy comparison because of the slowdown in advertising spend that happened last year due to the pandemic, but Google is showing once again that its core advertising business can grow even at this massive scale.

What's more, Google Services generated $22.3 billion in operating income in the quarter, giving the segment 39% operating margins. Margins continue to march higher for Google Services, too. For example, in Q2 of 2017 Google Services had 29% operating margins, meaning that in the last five years the segment has expanded margins by 10%. As this business continues to scale over the next five years, investors should expect this to continue.

YouTube shines

The highlight of the Google Services segment right now is YouTube. Revenue for the video platform hit $7 billion in Q2, up 84% year over year. Like Google Services as a whole, YouTube will not grow this fast indefinitely, but the platform is becoming more and more meaningful to Google's overall business every quarter.

On the conference call, management mentioned that YouTube shorts have surpassed 15 billion daily views, over 120 million people watch YouTube on TVs in the U.S. every month, and Google paid more to YouTube creators and partners than in any quarter of the company's history. The platform is also investing heavily in e-commerce tools for video creators, which is another large avenue of growth Google can go after.

While YouTube makes up only 11% of Google's overall revenue right now, the platform continues to dominate ad-supported video and still has plenty of room to grow around the globe.

Cloud chugging along

Outside of Google Services, the growth of Google Cloud remained strong in Q2, hitting $4.63 billion in revenue. Sales were up 53.9% year over year and now make up 7.5% of Alphabet's overall revenue. Researchers predict that the cloud computing industry will grow from $371.4 billion in annual spending last year to $832.1 billion in 2025.

With only a few companies like Amazon, Microsoft, IBM, Alibaba, and Oracle competing for cloud infrastructure contracts, Google Cloud has a clear path to grow revenue over the next five years.

Don't forget "other bets"

The "other bets" segment houses Google's moonshot projects, which are high-risk endeavors that may never reach commercial viability. In Q2, other bets revenue was a paltry $192 million, and it lost $1.4 billion, weighing on Alphabet's overall profit margins. While none of these projects will be meaningful for quite a while, if ever, a lot of them have tons of potential.

Waymo, the company's self-driving unit, has done tens of thousands of rides with no drivers in Phoenix, Arizona, and looks to have the lead in autonomous driving technology. Its artificial intelligence (AI) division DeepMind is on pace to amass a database of every single protein sequence known to science. Both of these projects (self-driving and AI) require billions in research to move the industries forward. Alphabet is one of the few companies in the world that can lose $1.4 billion on these projects while still generating tens of billions in consolidated annual profits.

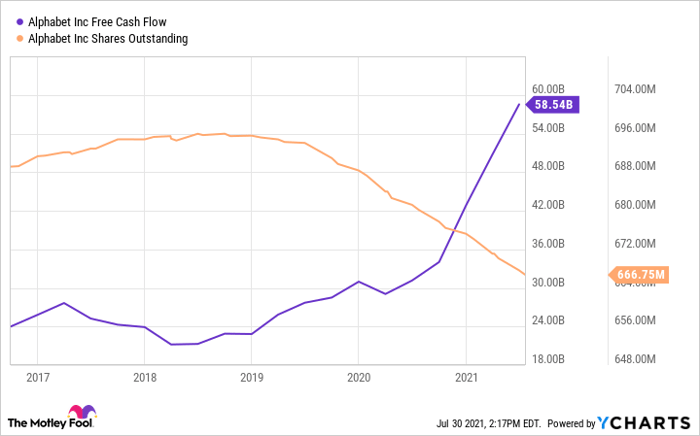

Share repurchases

Finally, Alphabet has recently poured billions into share repurchases, which will help return cash to shareholders and boost the company's overall free cash flow per share. Since the start of 2019, Alphabet's share count has gone from around 696 million down to 667 million, where it sits today.

Through the first half of 2021, Alphabet spent $24 billion repurchasing shares of its common stock. And with over $100 billion in cash and equivalents on its balance sheet and business units that generate tens of billions in cash a year, Google has a clear runway to repurchase more and more stock over the next decade.

GOOG Free Cash Flow data by YCharts

A lot of people (myself included) might think they've missed the boat investing in Google because the company now has a market cap of $1.8 trillion. But with Alphabet having so many exciting projects, increasing margins, and share repurchases, it looks like investors are still underestimating its stock.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.