This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Cryptocurrency has always been volatile, but it's experienced quite the wild ride over the past few months. After shattering records and reaching staggeringly high prices, cryptocurrencies have taken a sharp turn for the worse.

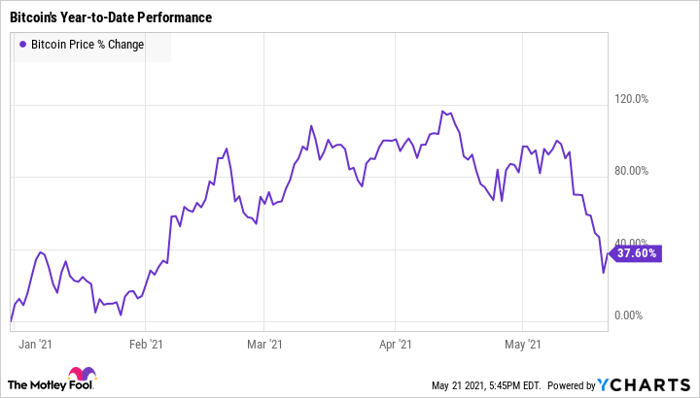

Bitcoin (CRYPTO: BTC), which reached a high of around $65,000 per token last month, has fallen by more than 30% over the past 10 days, as of this writing. Other popular cryptocurrencies Ethereum (CRYPTO: ETH) and Dogecoin (CRYPTO: DOGE) are also down around 30% over the same time period.

Sometimes, market crashes are beneficial to investors because they're an opportunity to buy stocks at bargain prices. If you've been eager to invest in cryptocurrencies but are hesitant about the sky-high prices, a crypto crash could make them more affordable. But does that mean you should invest?

Consider your tolerance for risk

The latest crypto crash is further proof of this sector's volatility. Considering cryptocurrency's history, a 30% drop is fairly mild. Bitcoin, for example, has fallen by more than 80% on three separate occasions since 2012, according to data from Visual Capitalist.

This year alone, Bitcoin has already experienced several steep drops. So this recent crash is par for the course -- and there will likely be many more crashes like this in the future.

Bitcoin Price data by YCharts

Before you invest in cryptocurrency, think about whether you can tolerate this level of risk. Although Bitcoin has always managed to bounce back from its slumps, there's no guarantee it will always recover.

If you know you're going to lose sleep when your investments plummet overnight, crypto may not be the best investment for you. But if you have the stomach for this type of turbulence, you may have the right personality for investing in crypto.

Choose your crypto carefully

If you decide to invest in cryptocurrency, buying when prices are lower may be a wise move. Especially if you're investing in a higher-priced currency like Bitcoin, you can get more for your money when buying during a downturn.

Just be sure you've done your research before you invest. The fact that a cryptocurrency is more affordable doesn't necessarily mean it's a smart investment, so consider all your options before you buy. The goal is to buy investments you can hold for the long term, so make sure you're choosing the right cryptocurrency for you.

Bitcoin is the biggest name in the crypto space, and it's also the oldest cryptocurrency. This gives it a leg up on the competition. However, it's an energy-intensive cryptocurrency, which poses environmental concerns. In fact, Tesla CEO Elon Musk recently announced that the company would no longer accept Bitcoin as a form of payment because of its environmental impact.

Ether is the second-most popular cryptocurrency, and it uses the popular blockchain Ethereum -- which is also the blockchain behind non-fungible tokens (NFTs) and decentralized finance. Because the Ethereum blockchain has a variety of uses, that gives it an advantage. In addition, developers are currently working on Ethereum 2.0, which will be more energy-efficient and environmentally friendly.

Dogecoin is one of the riskiest cryptocurrencies, and buying this particular token is more similar to gambling than true investing. If you do choose to go this route, be sure you make this decision carefully.

Regardless of which option you choose, only invest money you can afford to lose. Crypto is still a high-risk investment, even if it is more affordable right now. While cryptocurrency isn't right for everyone, if you've decided to invest, you can save some money by investing when prices are lower.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.