This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

Shares of Facebook, Inc. Common Stock (NASDAQ: FB) were climbing last month as the social media giant benefited from optimism about the vaccine rollout and the economic recovery later this year as well as some bullish analyst chatter. There was no major news out on the company last month, but the tech stock did seem to benefit from a rotation out of high-priced growth stocks and into value stocks, which includes Facebook since the company now trades at a discount to the S&P 500.

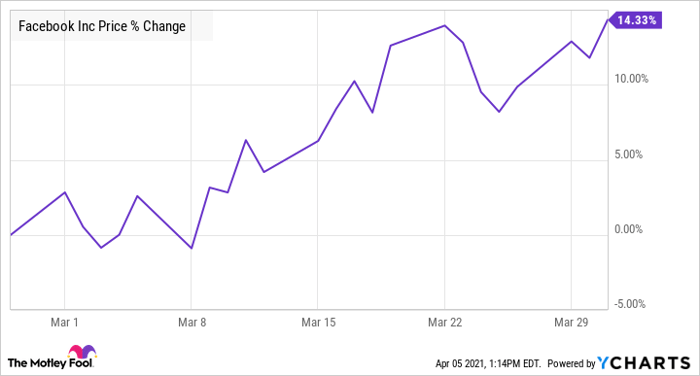

According to data from S&P Global Market Intelligence, the stock finished the month up 14%. The chart below shows the gains during March.

FB data by YCharts.

So what

Jefferies was the first analyst group to share its support of Facebook last month as analyst Brent Thill said on March 8 that the stock looked attractive following a recent pullback. He added that it trades at a 40% discount to the Nasdaq despite expectations that revenue growth will accelerate in 2021.

Over the course of the month, Facebook also had several blog posts laying out its strategy in human-computer interaction, or augmented reality (AR) and virtual reality (VR), and the company said it was working on a wristband that would control AR glasses. Facebook sees VR and AR as the next frontier in technology, and its Oculus platform is one of the leaders in the space.

CEO Mark Zuckerberg also pleased investors when he did an about-face on Apple's iOS 14, saying that he was confident that his company would be able to manage through the privacy shift, noting the strength of Facebook and Instagram Shops.

Toward the end of the month, Facebook's WhatsApp also got approval to handle peer-to-peer payments in Brazil, and Deutsche Bank lifted its price target from $355 to $385 and kept a buy rating on the stock, noting positive feedback from the advertising community.

Now what

Facebook has gotten off to a good start in April as well. A strong jobs report pushed the narrative of economic recovery, and the analyst endorsements continued to roll in as Barron's called the stock a buy over the weekend, and said it wouldn't stay cheap for long.

Even at an all-time high, it still looks reasonably priced at a P/E ratio of 30. Keep an eye out for its first-quarter earnings report coming on April 28. The stock could take another step up if Facebook delivers a strong report again.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.