Qantas Airways Limited (ASX: QAN) is completely dominating domestic aviation in the post-COVID era, holding 74% of the market in December.

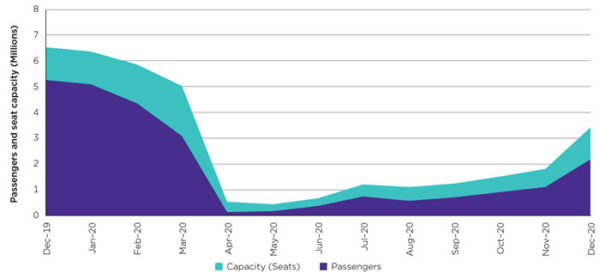

That's according to the Australian Competition and Consumer Commission's Airline Competition in Australia report released Wednesday, which showed industry-wide, passenger numbers were still just 41% of pre-COVID levels.

"Australia's domestic airlines are starting to experience a recovery in their passenger numbers, but it remains a very challenging environment," said ACCC chair Rod Sims.

Intrastate flights dominated in 2020 due to state border closures, but interstate travel made a comeback at the end of the year. December saw 69% of domestic passengers flying to a different state, compared to just 26% in September.

The return of interstate travel gave Qantas' biggest rival Virgin Australia a boost, with its market share going from 20% to 24% in the final quarter.

Qantas shares were down 0.36% to go for $5.46 in early trade on Wednesday.

There was no 'expensive' period last Christmas

It seems Regional Express Holdings Ltd (ASX: REX)'s challenge of the Qantas-Virgin duopoly had a profound effect on domestic aviation.

Even though Rex only started flying between metropolitan cities this month, including the lucrative Sydney-Melbourne route, its mere threat meant tickets remained inexpensive over Christmas.

"Domestic airfares normally peak over holiday periods but we didn't see that happen in December, partly because the three airline groups offered competitive promotions in a bid to get customers back in the skies," Sims said.

"With three carriers on Australia's busiest route, competition has been vigorous and consumers are the beneficiaries of this. Each airline will need to work hard to win over consumers."

Rex plans to add more big city flights – Adelaide, Gold Coast and Canberra are coming on board within weeks.

Regional Express shares were up 1.19% in early Wednesday trade, to sell for $1.695. They were just 71 cents one year ago.

Plenty of support for aviation sector

The industry is awash with government subsidies at the moment.

The Regional Airline Network Support and Domestic Airline Network Support schemes were brought in during the COVID-19 downturn last year. It was due to end in March but has since been extended to the end of September.

Then last week the federal government launched its new Tourism Aviation Network Support Program, which sees air tickets to 13 tourist destinations 50% subsidised.

Sims noted that the 3 major airlines are targeting slightly different demographics.

"It appears that Virgin and Rex are both targeting business and leisure customers who value a certain level of service but are also mindful of the price," he said.

"This may leave Qantas facing less competition for premium customers, and through its Jetstar brand, for budget holiday customers as well."

The ACCC's quarterly report on the aviation industry was commissioned by treasurer Josh Frydenberg last year in the midst of the coronavirus downturn.