The Insurance Australia Group Ltd (ASX: IAG) share price is on a roller coaster today. Shares in the insurer crashed 10.6% to a 5-year low of $4.30 before being placed in a trading halt. Since resuming trade, the share price is at $4.60, almost 5% down on yesterday's close.

In contrast, the S&P/ASX 200 Index is up 0.47%.

Let's take a closer look at what is weighing on the IAG share price.

IAG and Greensill's insolvency

As previously reported, Greensill was a supply-chain debt provider. Its business model was to provide funds to suppliers awaiting accounts receivable in the form of a loan to the purchasing business.

As with the 2008 financial crisis, Greensill collateralised these debts into securities and sold them to investors. Greensill became too reliant on a few companies and when COVID-19 hit, many loanees were unable to repay their debts.

According to the Australian Financial Review (AFR), BCC (an insurer IAG had a 50% stake in) sold policies to Greensill in 2019 covering the bonds. However, as IAG clarified in an announcement to the ASX, "it has no net insurance exposure to trade credit policies including those sold through BCC to Greensill entities."

IAG sold BCC in April 2019 to Tokio Marine Management (TMM) and completed the transaction by July. IAG informed the market TMM retained the risk for all policies during this period – including Greensill. Both BCC and IAG refused to renew their policies with Greensill this year. Greensill admitted in court the move was catastrophic. That was the catalyst for its insolvency.

Before IAG released its statement today, investors were panicking. Many believed IAG may be liable for the bad debts owed to Greensill. Fearing the worst, owners sold off their holdings in the insurer. IAG then placed its shares into a trading halt.

When IAG informed the market no such liabilities existed, many came flocking back on the resumption of trade.

Simply put, as more investors were selling IAG shares than buying, the price collapsed. When more investors began purchasing IAG shares than offloading, the price increased. In economics, this is known as the laws of supply and demand.

IAG share price snapshot

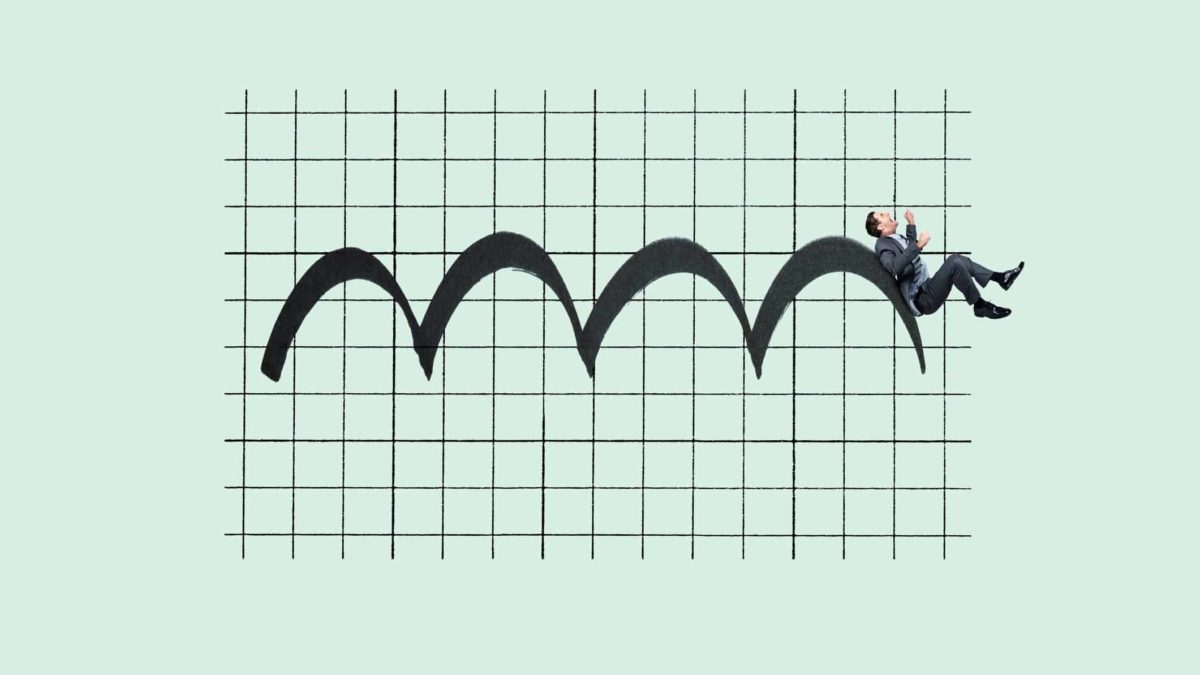

Today aside, IAG's share price has been sliding for the past year. One year ago, the insurer's share price was $6.36. At today's price, this calculates as a 27% loss in value. In fact, in mid-2018, the IAG share price was around the $8.80 mark.

IAG has a current market capitalisation of $11.7 billion.