Global hospital group Ramsay Health Care Limited (ASX: RHC) gave investors something to cheer about last week when it released its first-half results for the 2021 financial year. The Ramsay Health Care share price rose 8% as the company announced net profit after tax (NPAT) was up almost 1%, despite the challenges presented by COVID-19.

Importantly for income investors, the company also announced it would resume paying dividends after not paying a final dividend in 2020. Here's what you need to know.

What is the Ramsay Health Care dividend yield?

Ramsay Health Care declared an interim dividend of 48.5 cents per share for the six months to 31 December 2020. This was down -22.4% on the same period in 2019 and because there was no final dividend paid in 2020 at the current share price of $68.49, Ramsay has a trailing dividend yield of just 0.71%, though it does come fully franked.

OK, so it's not hugely exciting. But, as we can see from the company's dividend history below, there are good reasons to think this may just be a short-term, COVID-19 induced blip.

When does Ramsay Health Care pay its dividend?

The Ramsay Health Care share price will go ex-dividend on Monday, 8 March 2021. The 'ex-date' is when the shares start selling without the value of their next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Wednesday, 31 March 2021.

What does Ramsay Health Care's dividend history look like?

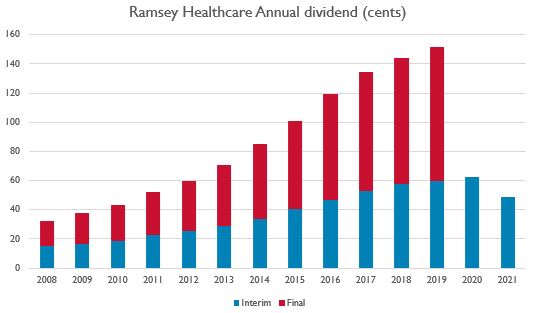

Ramsay's dividend history over the last decade makes for quite a sight. If there are two things dividend investors love to see it's consistency and growth, both of which Ramsay was delivering hand over fist until COVID-19 hit in 2020.

The chart below shows how the company's dividend had been rising strongly right up until 2020:

Source: Chart compiled by author using data from Ramsay Health Care

When COVID-19 struck, elective surgery dropped in most of Ramsay's key markets and the company pivoted to providing more capacity to the public sector through special government arrangements.

Earnings fell as a result and in the ongoing uncertainty, Ramsay decided not to pay a final dividend in 2020. The company also raised $1.5 billion in equity to strengthen its balance sheet and repay debt.

How much of its earnings does Ramsay Health Care pay out?

Over the last five years, Ramsay Health Care has typically paid out around 50% of diluted earnings per share in dividends. This was slightly lower (40%) in 2020 as the company held back its final dividend.

By retaining some of its earnings, Ramsay is able to reinvest back into the business, developing new hospitals or paying back debt, which helps to grow earnings and dividends over time. Investors will no doubt hope that continues to be the case so they have something else to cheer about when the company releases its full-year results for 2021.