Last week health insurance provider NIB Holdings Limited (ASX: NHF) released its first-half results for the 2021 financial year. Investors were certainly pleased to see net profit after tax (NPAT) jump by almost 16% as the NIB share price jumped 2.5% on the day.

Importantly for income investors, the company also announced details on its interim dividend. Here's what you need to know.

What is NIB's dividend yield?

In tandem with the half-year results, NIB declared an interim dividend of 10 cents per share for the six months to 31 December 2020. This was in line with the same period last year and means NIB shares have a trailing dividend yield of 2.5%, fully franked, based on the current share price of $5.60.

When does NIB pay its dividend?

The NIB share price will go ex-dividend on Thursday 4 March 2021. The 'ex-date' is when the shares start selling without the value of its next dividend payment so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Tuesday 6 April 2021.

What does NIB's dividend history look like?

We can learn a lot by looking back at a company's dividend history. For example, we can see how consistent or lumpy dividend distributions are. This can help us better understand the nature of the business and whether it is growing (or not!) over time.

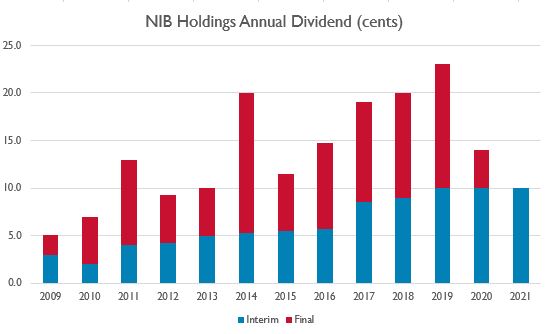

From the chart below, we can see that the NIB dividend had been rising steadily until 2020, when the impacts of COVID-19 contributed to a big drop in the company's profit margins and investment income.

Source: Chart compiled by author using data from NIB.

Did you spot the big spike in 2014? Nice! As part of NIB's capital management plans, the final dividend in 2014 was made up of both an ordinary dividend of 5.75 cents per share, plus a one-off special dividend of 9 cents per share to return extra cash to investors. Ka-ching!

How much of its earnings does NIB pay out?

NIB has typically aimed for a payout ratio of 60% to 70% of the company's normalised net profit after tax (NPAT). True to form, this has been the case over the last five years with an average payout ratio hovering right around 70% of NPAT. A payout ratio of 60% to 70% is more likely to be sustainable over the long term than if the company was to pay out 90% or 100% of its profits.

However, because dividends get paid from cash, not accounting profits, it is also a good idea to check that the company's cash flows from operations are sufficient to cover the dividend being paid out. If the dividend being paid was more than the cash flow the company earned from operations, this could be a warning sign the dividend may not be sustainable.