This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

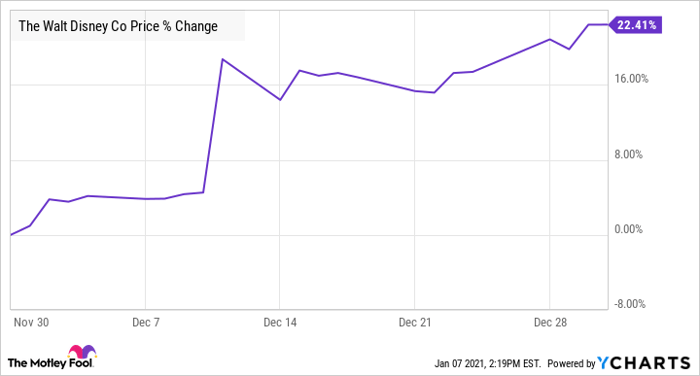

Shares of Walt Disney Co (NYSE: DIS) jumped last month after the entertainment giant unleashed a wave of impressive updates at its investor day conference on 10 December, including a significant expansion in its goals for Disney+ and the rest of its streaming services. That news helped propel the stock up 22%, according to data from S&P Global Market Intelligence, hitting an all-time high in the process.

As you can see from the chart below, shares surged on the update and tacked on more gains at the end of December.

So what

Disney stock rose 13.6% on 11 December following the announcements at the investors conference. Shareholders seemed most excited about the new streaming forecasts, as the company now expects to reach 300 million-350 million subscribers by 2024 across its streaming services, which include Disney+, Hulu, and ESPN+. That's up from 137 million currently and a reflection of Disney's plans to dramatically ramp up content for its services. Included in that guidance is 230 million-260 million Disney+ subscribers, up from 86.8 million currently and much better than its original forecast of 60 million-90 million subscribers by 2024.

Over the next few years, the company also plans to release 10 Star Wars series, 10 Marvel series, and 15 Disney series, including animation, live action, and Pixar. The entertainment giant also said it would raise the monthly price on Disney+ from $6.99 to $7.99.

Now what

Disney had already announced earlier that it would restructure its entertainment division around Disney+, and the news at its investor day has only reinforced shareholders' confidence in that strategy. Considering that Netflix Inc (NASDAQ: NFLX) has a valuation north of $200 billion, it seems reasonable to expect Disney shares to climb as its streaming services become preeminent and the company is valued more like a growth stock.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.