Qantas Airways Limited (ASX: QAN) has started selling international flights for July and beyond.

The airline had previously ruled out resumption of flights to COVID-19 hotspots like the United States and United Kingdom until at least October. It had also planned a gradual restart of international services with Singapore, Hong Kong and Tokyo resuming from the end of March.

But now all that seems to have been thrown out the window, with almost the entire international catalogue available to book from July onwards.

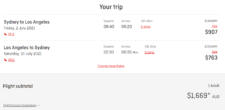

The Motley Fool has confirmed this on the Qantas website, able to see a $1,669 return fare to Los Angeles departing on 2 July.

"We continue to review and update our international schedule in response to the developing COVID-19 situation," a Qantas spokesperson told The Motley Fool.

"Recently we have aligned the selling of our international services to reflect our expectation that international travel will begin to restart from July 2021."

A needle (or two) before that overseas trip

The airline's chief executive Alan Joyce had previously flagged that coronavirus vaccination would be compulsory for international passengers.

"Talking to my colleagues in other airlines around the globe, I think it's going to be a common theme," he said in November.

"What we're looking at is how you can have a vaccination passport, an electronic version of it, that certifies what the vaccine is. Is it acceptable to the country that you're travelling to?"

Qantas' may have become emboldened due to the prospect of a March rollout of vaccines in Australia.

Federal health minister Greg Hunt last week pulled forward his previous target of having the nation vaccinated by the end of the year.

"We expect that Australians will be fully vaccinated by the end of October – on the basis it's free, it's universal, and it's entirely voluntary," he said.

"But we want to urge as many Australians to be vaccinated, and we've seen some very heartening reports over the weekend of an expected uptake of up to 80 per cent."

Not all international routes are back though

While most international routes seem to have resumed, one popular destination is still a no-go zone.

Travel website Executive Traveller reported Qantas' service to New York City seems to be missing in the July reboot, as is Sydney to Santiago.

The publication also noted the Sydney-Hong Kong route is starting with a once daily schedule, rather than the pre-COVID frequency of twice daily.

Qantas previously estimated its domestic business by Christmas would be about 60% of pre-COVID levels. But the international arm had been at a standstill since March when the pandemic quashed demand.

Qantas shares have been down in the past month due to the resurgence of the virus in Sydney and Melbourne. At the time of writing, the Qantas share price is trading down 1.63% at $4.83.