This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

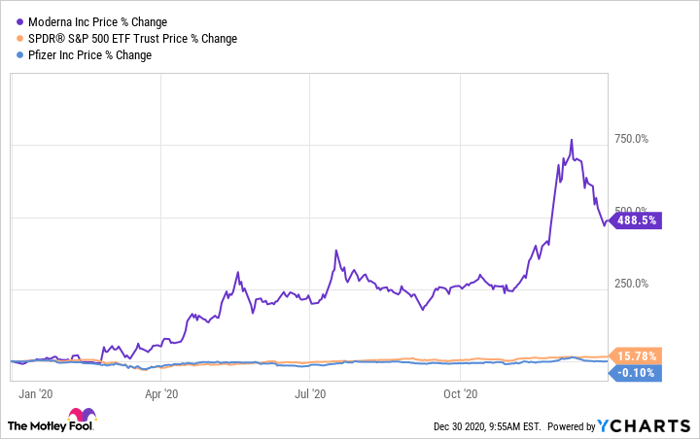

All eyes were on the biotech Moderna (NASDAQ: MRNA) in 2020. It wasn't quite a popular name in the pharmaceutical space, as it has no approved products on the market yet. But its sudden entry in the COVID-19 vaccine competition grabbed a lot of attention, and it became the second company to win approval in a race with dozens of players. No wonder its stock has surged 488% so far this year, while the S&P 500 has gained 16%.

On Dec. 11, Pfizer (NYSE: PFE) and its German biotech partner BioNTech (NASDAQ: BNTX) became the first to receive an Emergency Use Authorization (EUA) from the Food and Drug Administration for a coronavirus vaccine candidate, BNT162b2. Moderna became the second company to receive the EUA for its vaccine, mRNA-1273, on Dec. 18. The former vaccine displayed 95% efficacy while the latter showed 94.1% efficacy in the still-ongoing phase 3 trials.

So now that Moderna's vaccine is out and the inoculation process has begun, is the company still a good investment?

Now that the vaccines are out, we will see how effective they are in treating COVID-19. At one point in December, Moderna's stock had surged up to 768%, but it seems to be simmering down now. That could be because the vaccine market has tremendous competition, and ultimately the value of one particular vaccine might decline.

Investing in this market is risky. Moderna did wonders in a short period, but its future heavily depends on its COVID-19 vaccine. Most of its other vaccines in clinical trials use the same mRNA technology, so the success of mRNA-1273 will validate other treatments in its pipeline. There's a lot riding on the vaccine's success.

If you're already invested in Moderna, I would suggest holding it. And any investors who still want an entry in this risky game should keep their allocation small with this biotech.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.