The second best performing ASX sector this year is well placed to take the top position in 2021.

I am talking about the Materials sector, which is dominated by ASX mining stocks. This group rallied nearly 13% in 2020 when the S&P/ASX 200 Index (Index:^AXJO) is struggling to reach breakeven.

Only the ASX Technology sector is beating Materials. This is largely due to to the big surge in the Afterpay Ltd (ASX: APT) share price and Xero Limited (ASX: XRO) share price.

ASX miners to outperform ASX tech stocks?

But while the outperformance of ASX tech stocks have pushed these stars into the valuation stratosphere, many ASX miners are still looking cheap.

It's for this reason I think mining stocks will overtake tech stocks in 2021, particularly given the outlook for commodity prices.

Citigroup believes miners could keep their edge in 2021. If the broker is right, it will mark the sector's fifth year of outperformance against the general market.

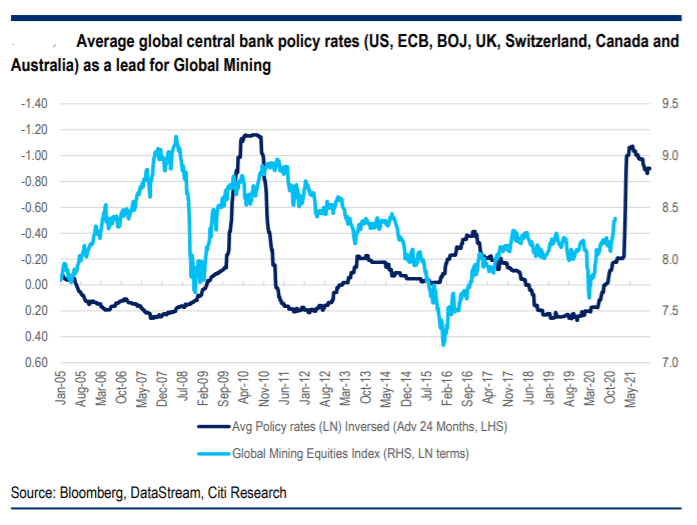

Monetary policy a lead indicator

"Key markets China and the US are running supportive monetary policy," said the broker.

"Citi expects China M2 and TSF [total social financing] to grow around 9% and 11% in 2021. Global central bank policy rates point to the potential for upside surprise in Global Mining equity indices in CY21 should we see a strong coordinated recovery in global growth across key metal intensive economies."

TSF purports to measure the total amount of funds going into the real economy from the entire financial system.

Easing commodity prices not a big threat

While analysts believe the record high iron ore price of over US$170 a tonne is not sustainable through 2021, our iron ore producers will still be generating a lot of cash.

Citi believes the price of the commodity will average US$115 a tonne in 2021 before gradually slipping to US$74 a tonne in 2024.

Even then, the broker estimates that Rio Tinto Limited (ASX: RIO) will make enough to repurchase around 13% of its shares. That would put the Rio Tinto share price on a price to cashflow (PCF) multiple of 7.2 times, which is cheaper than the through cycle average.

How to get the best return from ASX mining sector

UBS is also upbeat on the sector as it sees material valuation upgrades across the sector if spot prices can be sustained.

However, to get the best bang for your investment dollar, the broker believes you should sell the strongly performing base metal miners and buy precious metal miners.

It is also urging investors to hang on to bulk miners like the iron ore producers.

Some miners that UBS prefers include the Fortescue Metals Group Limited (ASX: FMG) share price, Newcrest Mining Ltd (ASX: NCM) share price and South32 Ltd (ASX: S32) share price.