This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Most of us, investors and otherwise, had mentors tell us at one time or another to "never say never." While that adage may also apply to stock investing, I think an exception should be made for Square (NYSE: SQ).

Despite its name, this financial services and mobile payments specialist is anything but boring or conventional. The way the company is shaking up finance, investors could square away gains in this fintech stock for years to come. Let's examine three reasons why.

1. The (more) cashless society

Indeed, many investors want to cash in on the so-called "cashless society." They base this on a perception that physical currency will disappear.

Despite my bullishness on Square stock, I would not go so far as to assert that. However, cash has significant limitations, most of which Square's products help address. Individuals have gravitated toward these options in increasing numbers.

This is particularly true of Square's Cash App. It allows users to square up their payments, banking, and even their stock or bitcoin purchases on the application.

The success of the Cash App is even exceeding management's expectations. In the third quarter, Cash App drove gross profit growth of 212% over the prior year. As of June, usage had grown to more than 30 million monthly active users.

2. The Square ecosystem

Moreover, beyond Cash App's versatility, Square has built a full finance ecosystem.

In the previous century, finance companies did not venture into multiple financial operations. One might have turned to a Bank of America for personal banking and a mortgage. An enterprise like Charles Schwab would have handled stock trading. For those who owned a business, a company like ADP might have managed payroll. That enterprise may have also collected money in a cash register made by NCR.

Square can perform all of those functions within one ecosystem. This has led to fundamental changes in the public's relationship with the finance industry.

Due to these changes, people may decide they simply need Cash App and will close their bank and brokerage accounts. Businesses could also drop payroll and cash management companies in the same manner.

Consequently, Square could send its detractors running in circles. Due to this one-stop-shop for all things money, some may charge the company with "taking over finance." Although I would stop short of making that prediction, such a belief could cement Square's place in the fintech industry.

3. The state of Square stock

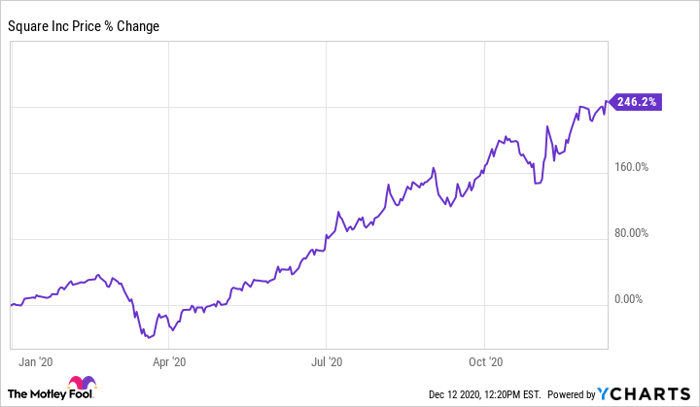

More importantly to investors, such a perception will inevitably help Square stock. Indeed, its performance has already driven massive shareholder value. Its stock price has risen by nearly 250% year to date.

With that level of growth, few would describe it as a "cheap stock." Nonetheless, it is not as expensive as it appears.

Indeed, a forward P/E ratio of 175 seems pricey. After all, diluted earnings per share rose by only about 17% year over year in the most recent quarter. That may not appear high enough to support such a valuation.

However, revenue surged by almost 140%, driven in part by an 11-fold increase in bitcoin revenue. The bitcoin revenue comes with razor-thin profit margins.

Still, most of the increased profits came from transaction and subscription-based revenue. Square invested most of that profit increase back into the business. This move should lead to higher shareholder returns in the long run.

Furthermore, its price-to-sales (P/S) ratio stands at only about 13. This compares well to its rival, PayPal. Also, its P/S ratio is about one-third that of what some have called the "Square of Brazil," StoneCo.

The bottom line

No matter what happens with the stock in the near term, Square continues to change how individuals and businesses interact with money.

Through the Cash App, it connects individuals to the cashless society. Additionally, with the Square ecosystem, more customers could drop bank accounts and other financial products that were once considered essential.

The company's successes have taken the stock to new highs. Investors who buy Square and square it away will probably see the shape of their stock portfolios continue to improve.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.