This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

While the United States still has a long way to go to match China as a cashless society, PayPal Holdings Inc (NASDAQ: PYPL) is helping the U.S. bridge the gap. PayPal has struck deals with several major retailers to use its QR code solution at checkout. If its technology becomes more widely adopted, PayPal will cement its position in the rapidly expanding digital payments market.

Here's what PayPal's QR code solution could mean for its growth.

A momentous year for PayPal

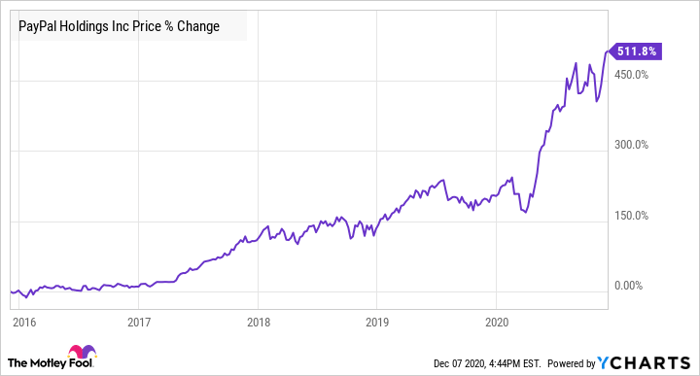

PayPal Holdings reported stellar earnings results through 2020, as mobile payment adoption soared during the pandemic. In the third quarter, total payment volume and revenue grew 36% and 25%, respectively, excluding currency changes. That's the strongest growth in the company's history.

Even though more people are using mobile payments, the U.S. still lags China, where 53.5% of the population is estimated to use in-store mobile payments, according to eMarketer. In 2019, 64 million people in the U.S. used in-store mobile payments, which is about one-fifth of the population. That gap in mobile payments usage between the U.S. and China is PayPal's opportunity.

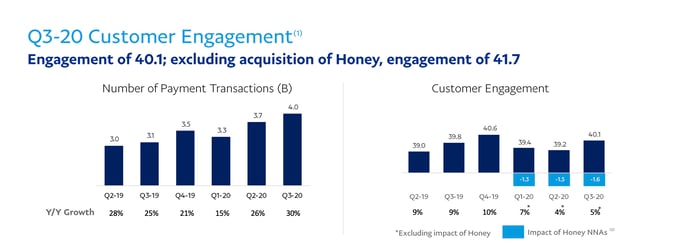

PayPal is on pace to gain 70 million net new active accounts in 2020. Those new customers should bring in even more transactions and fuel further growth for PayPal's platform, which just hit a record 4 billion transactions processed in the third quarter.

Growth in new customers is not a problem for PayPal. The real challenge is figuring out ways to increase the frequency that users transact with their accounts for everyday purchases. Since PayPal makes most of its money by charging fees for each transaction processed, increasing customer engagement is a key ingredient to driving revenue growth and fueling returns for shareholders.

As of the third quarter, PayPal's transactions per active account stood at 40, which means users made a transaction at a rate of less than once per week over the last year. It is encouraging that PayPal can generate $20 billion in revenue and $3.1 billion in net profit with customers using their account as infrequently as they currently do.

Just imagine what those numbers would look like if PayPal achieves its long-term goal of making its platform an everyday use case for its users. Revenue and profits would certainly be multiples higher than they are now. PayPal's new QR code checkout solution is taking a big step in that direction.

Image source: PayPal Q3 2020 earnings presentation.

Major retailers are adopting PayPal's checkout technology

In May, PayPal announced that its QR code payment solution was available to buy and sell goods across 28 markets worldwide. It was marketed as a "touch-free way to buy and sell in-person." Given PayPal's 361 million active customer accounts, it didn't take long for large retailers to sign up to tap into that large installed base of users.

In July, CVS Health's pharmacy chain became the first national retailer to integrate PayPal and Venmo QR code technology at checkout across 8,200 CVS Pharmacy stores.

More deals have followed, including with Nike and Bed Bath & Beyond. There could be more announcements coming, as PayPal remains in talks with more than 100 large retailers.

The launch of its QR code solution does more than expand PayPal's addressable market to offline payments. For example, when people use two or more of PayPal's products, including checkout solutions and peer-to-peer payments, it drives down customer churn by 50%. In other words, QR codes are another way to make PayPal's brand more ubiquitous, easier to use, and a stickier experience for customers.

PayPal's move into offline retail will be a "multiyear journey," as CEO Dan Schulman explained during the third-quarter conference call. But he also acknowledged that management is already seeing "strong early adoption" of its QR code technology, which is a great sign for the company's long-term growth prospects.

Investors are high on PayPal's prospects

This growth stock has seen its valuation stretch to a high forward price-to-earnings (P/E) ratio of 57 recently. That could limit further gains in the very near term, but PayPal can grow into that valuation over the long term. Management believes the business is now on a trajectory to grow faster than the original medium-term outlook of 17% to 18% annual currency-neutral revenue growth.

It might be tempting for investors who bought shares earlier this year to sell and lock in quick gains, but given the enormous opportunities PayPal still has in a wide-open market, this is a stock worth holding for the long haul.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.