This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

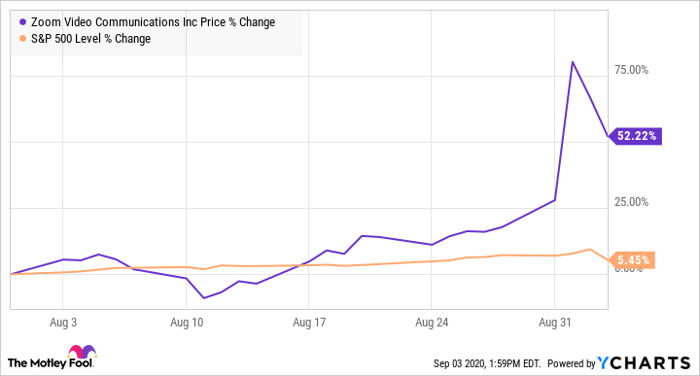

Shares of Zoom Video Communications (NASDAQ: ZM) were up 28% in August, according to data provided by S&P Global Market Intelligence. The stock's outsized gains didn't get started until later in the month when analysts began predicting blow-out results for the company's upcoming second-quarter earnings report. Investors began bidding up the stock in anticipation.

Zoom reported earnings on Aug. 31, and calling it a blow-out quarter would be an understatement. A Bank of America analyst had one word to sum it up: "unprecedented."

ZM data by YCharts.

So what

Multiple analysts issued bullish statements on Zoom stock in August. For example, RBC raised its Zoom price target by 20% to $300 per share. And Rosenblatt Securities raised its price target by 24% to $260 per share. All analysts expected incredible revenue growth from the company – consensus estimates placed Zoom's Q2 revenue at around $500 million. In the days leading up to report, investors started piling in, hoping to see some sort of pop after earnings.

I think, by now, you know the rest. Zoom stock rocketed around 40% higher to new all-time highs after its Q2 report. Its results obliterated even the most bullish expectations. The company reported revenue of $664 million, an increase of 355% year over year. Its net cash from operations was $401 million – up almost 13 times from the year-ago quarter.

Now what

Zoom issued guidance for its fiscal 2021 (its current year). The company expects full-year revenue of $2.37 billion to $2.39 billion, and non-GAAP (adjusted) diluted earnings per share of $2.40 to $2.47. Given its current market capitalisation of around $110 billion, that means Zoom stock currently trades around 46 times fiscal 2021 sales and around 164 times non-GAAP earnings. That's a hefty price to pay, even for a growth stock of Zoom's calibre.

The debate isn't whether Zoom can grow in the near term – investors are divided about whether Zoom can grow at a rate to justify its valuation over the long term. Furthermore, some believe Zoom's video conferencing tool is merely being used now out of necessity, but customers will bail once COVID-19 is far in the rearview mirror.

This is a good time for Zoom bulls to review their investing theses, given the stock's current valuation, to see if they are prepared to continue holding for the long term. Likewise, Zoom bears should consider that top companies often find ways to keep growing and winning – sometimes going down new, unforeseen avenues. In Zoom's case, it sees plenty of growth to come in areas like telehealth and Zoom phone, a multifaceted business communication tool.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.