This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

The stock market crashed hard on Thursday, Sept. 3. At 1:15 p.m. EDT, the Dow Jones Industrial Average stood 2.6% lower and the broader S&P 500 index had fallen 3.4%. The tech-heavy Nasdaq Composite led the pack with a decline of 4.6%, giving us a big clue to the drivers of this sharp market drop.

A familiar trio of trillion-dollar market caps led the way here. Shares of iPhone maker Apple (NASDAQ: AAPL) posted a 6.8% loss and software giant Microsoft (NASDAQ: MSFT) slumped 5.9%. Google parent Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) fared slightly better, limiting its decline to approximately 5.3%.

Together, these sudden dives added up to $382 billion in lost market value at press time.

So what

None of these tech titans had any terrible news of their own yesterday. If anything, their business updates should have moved the stock prices higher. Apple introduced a new feature for mobile app developers designed to boost the number of paying subscribers for iOS apps through easy-to-use subscription offer codes. Google scored a big win with cloud computing services helping the U.S. military predict cancer diagnoses. But investors shrugged off these mildly positive tidbits.

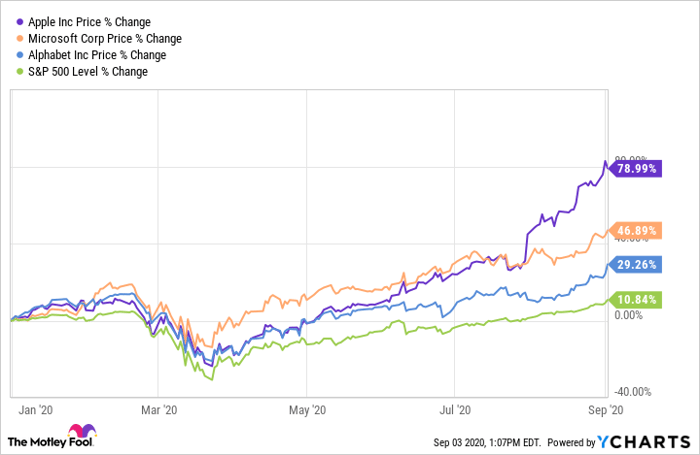

The sell-off starts to make sense when you look at Microsoft's, Alphabet's, and Apple's recent stock charts. Here's how the tech giants' stocks have performed in 2020 leading up to Thursday's dramatic correction:

There's no reason to cry for tech investors today, though. Alphabet's stock is still up 22% year to date, trailing Microsoft's 38% gain and Apple's enormous 67% price increase.

Now what

It's true that the COVID-19 health crisis has boosted the profile of many technology companies. Work-from-home policies are undeniably good news for businesses that sell products and services in the office productivity market, and all three of these companies are leaders in that space. At the same time, the stock market as a whole has been overheated lately. The major benchmarks are mostly back where they were before the coronavirus crisis, excepting the Nasdaq. A correction seems to be in order at this point, and things could get much worse if there's a second wave of COVID-19 cases in store.

To be clear, none of the stocks mentioned above did anything wrong. They're just being ensnared in the broader market slump. Their charts could very well turn upward again in a hurry, but there might also be further corrections on tap in the coming days. All of this depends on factors outside of Apple's, Alphabet's, and Microsoft's control, including coronavirus trends, election results, and the rate of political progress on a second stimulus bill.

This overdue correction is certainly no reason to panic. Everything you knew about these companies and their business prospects yesterday is just as true today. The only thing that changed was the market's attitude toward high-flying tech stocks in the face of rising uncertainty. You could even pick up some shares at lower prices today. Perfect market timing is an impossible game, but serious investors can take advantage of temporary price drops when they come along.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.