This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

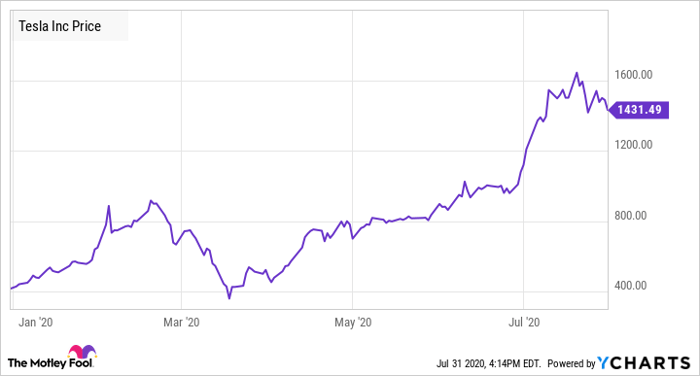

Shares of Tesla (NASDAQ: TSLA) roughly doubled in the first four months of 2020, despite a brief dip during the peak of the COVID-19 pandemic. This left Tesla stock trading near $800 at the end of April.

Elon Musk was skeptical of the rally, though. On May 1, the outspoken Tesla CEO tweeted, "Tesla stock price is too high imo [in my opinion]," causing the stock to plunge 10% that day. However, he didn't dent investors' enthusiasm for very long. Tesla stock resumed its rally in June and surged higher in July, briefly reaching an all-time high of $1,794,99 on July 13. While the share price has receded a bit since then, Tesla shares have still nearly doubled since Musk's tweet that the stock price was too high.

Data source: YCharts.

In the short run, Musk's assessment of Tesla stock appears to have been wrong. Nevertheless, he was right that growth-hungry investors have driven the stock to a level that can't be justified by the company's long-term earnings prospects.

Profitability has been subpar

Tesla's management has touted lofty margin goals over the years. On the company's recent earnings call, CFO Zach Kirkhorn mentioned a medium-term target of "low-teens" operating margins, with additional upside beyond that level. Just getting to 10% would put Tesla near the front of the pack in the global auto industry.

So far, though, Tesla's profitability remains mediocre. Last quarter, the electric vehicle pioneer reported operating income of $327 million, putting its operating margin just above 5%. Pre-tax income was just $150 million. Moreover, Tesla benefited from regulatory credit revenue nearly quadrupling year over year to $428 million. This revenue stream isn't sustainable in the long run: As other automakers ramp up electric vehicle production, excess credits will become far less valuable.

To be fair, Tesla was hampered by production disruptions due to COVID-19 last quarter. If we look back to the final quarter of 2019, operating income was $359 million and pre-tax income was $174 million, with a more modest $133 million contribution from regulatory revenue. These are extremely skimpy profits for a company with a market capitalization well above $250 billion.

Tesla lacks a mass-market strategy

As Tesla expands production -- it opened a new factory in Shanghai late last year and hopes to bring new plants in Berlin and Austin on line by late 2021 -- its profit margin should improve due to economies of scale. However, economies of scale alone aren't likely to boost Tesla's operating margin into double-digit territory (unless regulatory credit revenue unexpectedly continues surging).

The biggest impediment to margin expansion is Tesla's need to cut prices. Despite rolling out lower-priced variants of the Model 3 sedan and an affordable crossover (the Model Y), Tesla's average selling price has remained close to $60,000. High prices are good for gross margin, all else equal, but they aren't consistent with Tesla's goal to become a mass-market automaker selling millions and millions of cars annually. There are only so many people willing to pay that much for a vehicle.

Tesla has periodically cut its prices to make its vehicles slightly more affordable. Just a few weeks ago, it lowered Model Y prices by $3,000. Tesla's inability (or unwillingness) to develop a truly affordable car that can be produced cheaply means that it will have to continue reducing the prices of its existing models over time, offsetting some of the margin improvement that would otherwise come from gaining scale.

Don't count on software to save the day

With Tesla still struggling to achieve meaningful profits relative to its valuation, investors and management have turned to ever more speculative means of justifying its soaring stock price. For example, Piper Sandler analysts recently boosted their Tesla price target to $2,322, arguing that Tesla's operating margin could surpass 20% over the next two decades while selling cars near breakeven. The catch? Tesla would need to convince a substantial number of customers to pay close to $40,000 for a full self-driving software package.

The Piper Sandler analysis is conservative compared to Elon Musk's predictions that full self-driving capability could increase the value of each Tesla vehicle by "at least $100,000 per car."

Count me as extremely skeptical. One of Tesla's main selling points has been high performance. There's not much point to buying a performance car if you're going to have it on Autopilot all the time. And while Tesla owners may be able to make money by allowing their vehicle to operate in a future Tesla ride-hailing network when it would otherwise be idle, competition will sharply limit the revenue opportunity. Moreover, many people spending $50,000 or more on a car will be reluctant to turn it into a taxi.

Tesla is a great company that is driving a long-overdue transition to sustainable personal transportation. However, it has a higher market cap than any other automaker in the world despite its small size and low margins. Until the stock price comes down substantially, investors should stay away.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.