The Osteopore Ltd (ASX: OSX) share price surged over 30% around lunch time today before being rapidly sold down to a more modest gain of just 2.4% (at time of writing). The ASX medical share rallied following an announcement from the company regarding its development of a new 3D printed bone implant.

What did Osteopore announce?

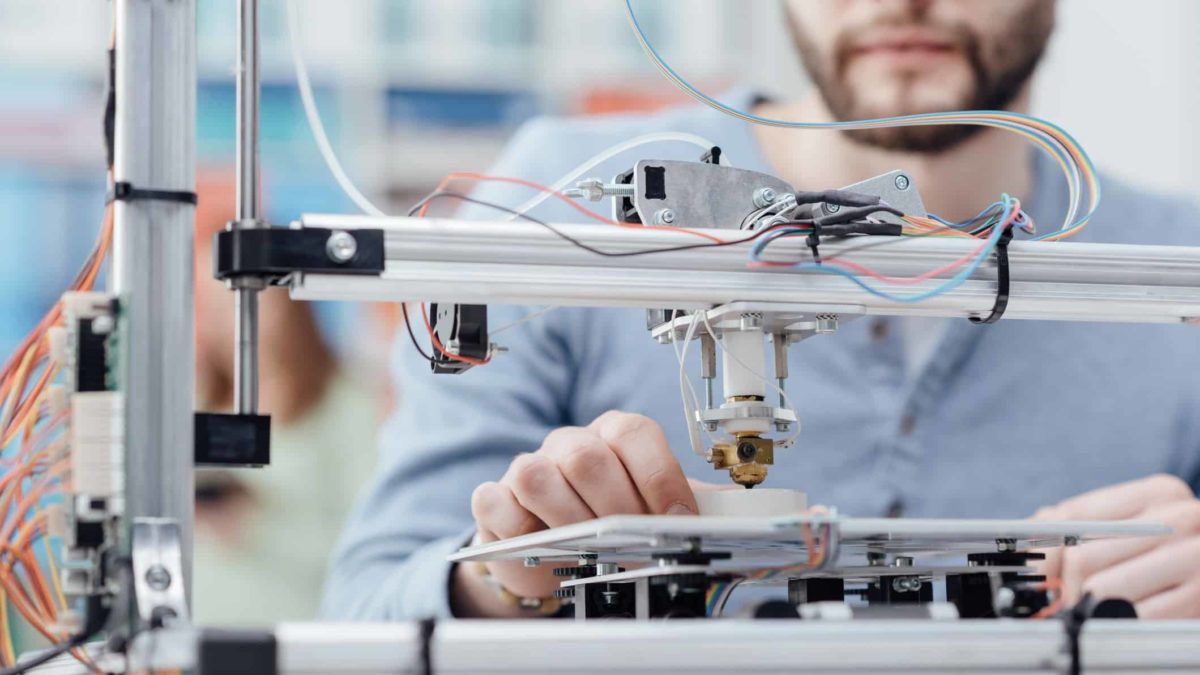

In a release to the market shortly after midday today, the company announced it has signed an Exclusive Option to licence novel 3D printed modular bone implant technology being developed at the Queensland University of Technology (QUT).

The technology has shown encouraging early stage results for regrowth of long bone defects in patients who have lost more than six centimetres of bone to injury or disease. Additionally, the technology has the potential to disrupt the supply chain model of customised implants.

Osteopore and QUT will collaborate to generate sufficient clinical data to support regulatory submissions to the Therapeutic Goods Administration (TGA), United States Food and Drug Administration (FDA) and European regulators. As a result, the evaluation of the technology could potentially lead to an opportunity to acquire it.

The agreement between the parties will progress through two stages. The first stage is to gather clinical data and stage two is regulatory approval and commercialisation. In stage two, Osteopore could have exclusive worldwide licence to commercialise the technology.

However, the company has advised that this project has a long development pathway and commercialisation of any product could take years. Worst case scenario, there may not be a product at all.

Terms of the agreement and potential market opportunity

Ostopore will provide $40,000 in cash, plus in-kind support and has secured a $100,000 non-dilutive grant from QUT. Under any future commercial agreement with QUT, the company would need to provide a market entry fee of $100,000 and provide royalties with a potential range of 2-6%.

The market has significant growth potential according to a Boston Consulting Group report published in 2015. In a more recent publication released in March 2018, Boston Consulting reported the compound annual growth rate (CAGR) for reconstructive implant in orthopaedic and spine as being 5.1%. As a result, the global market potential is expected to be $30 billion by 2022.

About this ASX medical share

According to its website, Ostepore specialises in the production of 3D-printed, bioresorbable implants that are used in conjunction with surgical procedures to assist with the natural stages of bone healing.

Since the announcement, and following its considerable but short-lived rally, the Ostepore share price has settled at 64 cents at the time of writing.