Recently I've been digging into business conglomerate Wesfarmers Ltd (ASX: WES).

From the outside, Wesfarmers looks like an odd collection of businesses. What does Kmart have to do with chemical production?? But the deeper I dig, the more congruence I find within the group.

For starters, the collection of businesses makes more sense when you look at the company's history. Wesfarmers was originally a general trading cooperative borne in sun-glazed, rural Australia. It originally sold hardware, chemicals and farming supplies. That's not too dissimilar from its businesses of today.

The second critical connection to recognise is that all Wesfarmers businesses follow the same, deeply valuable competitive advantage; low-cost leadership from large-scale operations. This applies across the board, from Bunnings and Kmart to the bulk production of ammonia.

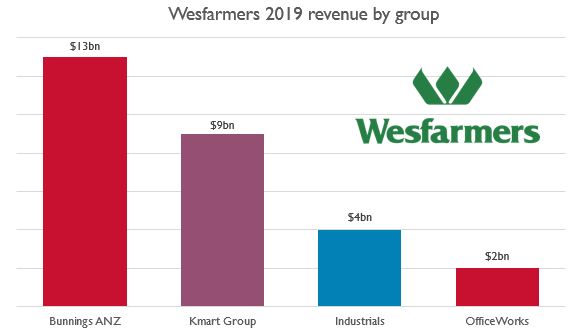

To better understand how these large-scale businesses contribute to the Wesfarmers group, here is a breakdown of the company's 2019 revenue by business unit (rounded to the nearest billion):

Source: Revenue from Wesfarmers 2019 Annual Report. Chart compiled by author.

Bunnings Australia and New Zealand (47%)

Low-cost hardware chain Bunnings is the jewel in the Wesfarmers crown. In the 2019 financial year Bunnings brought in $13 billion of revenue and had a robust earnings before interest, tax, depeciation and amortisation (EBITDA) margin of 12.3%. Yet the huge volume that Bunnings turned over across its more than 370 stores means that the division delivered a huge return on invested capital (ROIC) of 50%.

Kmart Group (31%)

Large-scale retailers Kmart and Target made up 31% of revenue in 2019 with a 6.3% EBITDA margin. Earnings actually fell in 2019, performing below management expectations. However the group still returned an impressive, 29% ROIC for the year.

Industrials (14%)

Wesfarmers industrial group includes the production of fertilisers, chemicals and energy and harks back to the organisation's roots as a rural trading company. Although the division brings in less than half the revenue of the Kmart Group, it contributed almost the same amount of profit at $524 million.

Officeworks (8%)

Officeworks needs little explanation. It made up 8% of total revenue in 2019 and operated with a moderate 7.2% EBITDA margin.

Foolish takeaway

At first glance, Wesfarmers is made up of a strange group of businesses which makes it more complex to assess as a potential investment. However, understanding the history of the business and the over-arching, low-cost approach of its portfolio helps to explain the make up of the company.