Let the good times roll!

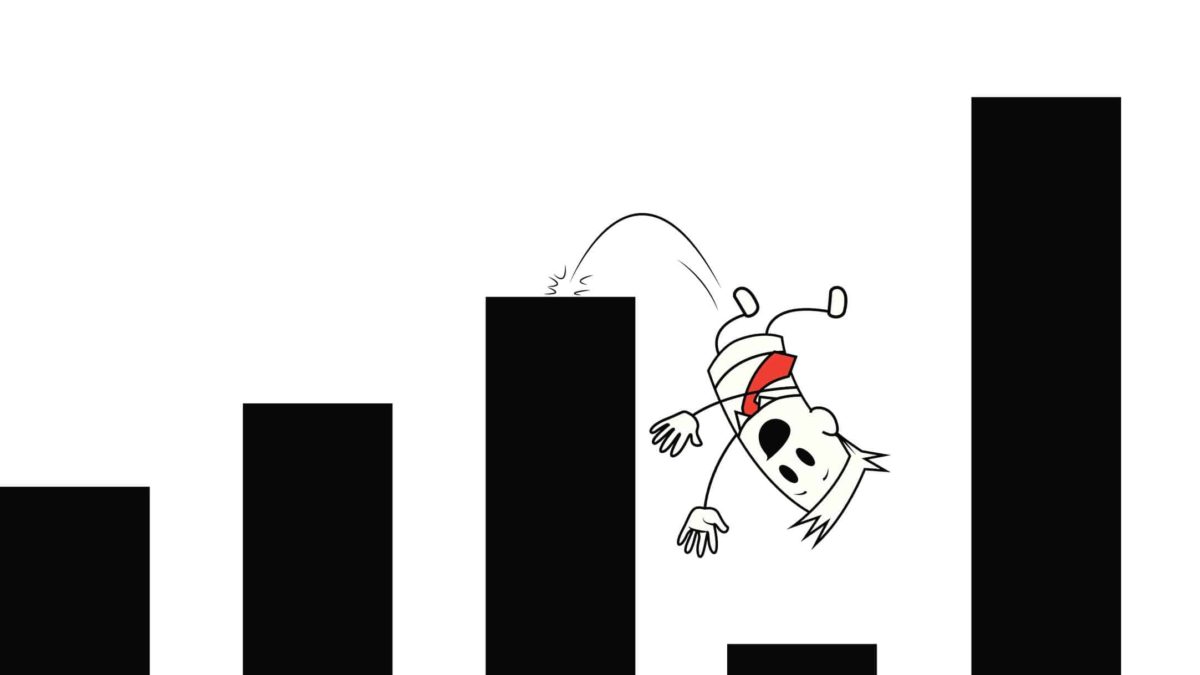

The S&P/ASX 200 Index (INDEXASX: XJO) has been a great place to have your money over the past 3 months. Since 23 March, the ASX 200 has appreciated more than 30%. But as the weeks of this bull market stretch into months, I think investors should use an ever-growing sense of caution to avoid making ASX mistakes.

Last week I wrote about how signs of dangerous investor behaviours are growing. Today, I'm suggesting 3 simple things to avoid in this bull market.

ASX mistake 1: Don't try and make a quick buck

There have been a lot of signs that some investors are trying to make a quick buck in this bull market. Whether its buying distressed companies like Webjet Limited (ASX: WEB) or taking punts on the price of oil through the BetaShares Crude Oil Index ETF (ASX: OOO), these kinds of movements are nothing more than gambling in my view. If you know this is what you're doing, then go for it. It's a free country. Just recognise that these kinds of trades can backfire very easily and even lose you 100% of your capital. If you want to actually invest rather than speculate, stick to buying businesses that you think will return your cash and more over the long-term.

2: Stay away from options trading

Options are financial derivative products that use leverage to 'make a bet' on which way a share price will go. They have been increasingly popular in recent months, particularly over in the United States. If you're an experienced investor that knows what they're doing, options can be a great way to make a small speculative investment or hedge your positions. But for most investors, I think staying away from options is a good idea. They are highly risky investments that rely on the whims of the share market. As such, I think the risk-reward ratio for most investors is skewed against them. As such, I would caution the use of options for most people out there.

3: Don't chase hype trains

In my view, investing is about finding quality businesses that you can feel comfortable investing in over many years, hopefully at a great price. Jumping into growth shares like Afterpay Ltd (ASX: APT), Zip Co Ltd (ASX: Z1P) or Splitit Ltd (ASX: SPT) just because they have been going up isn't a great long-term strategy in my view. It concerns, not excites me when I see something like Splitit go up more than 100% in a few days.

I think this attitude is far more conducive to good long-term returns than risking a major ASX mistake by jumping on something that looks to be shooting the moon, just so you can catch some of the potential stars.