If you haven't been investing long, or haven't started yet, I'm sure you wish you had started 10 years ago. Hopefully, in another 10 years, you won't be wishing the same thing.

Investing in the ASX has been a great tool to build wealth over time. To show just how powerful a tool it can be, rather than examining a specific company, we're going to look at a hypothetical case. Just how much would a $50,000 investment 10 years ago be worth today if it followed the returns of the S&P/ASX 200 Index (ASX: XJO)?

An investment in the ASX 200

An investment 10 years ago that tracked the ASX 200 would have returned approximately 30% today. So your hypothetical $50,000 investment would now be worth $65,000. Are you feeling a little underwhelmed? Then I suggest you continue reading, because that's not the full story.

This return is despite the ASX 200 having just surged out of the global financial crisis lows. Not to mention the index is currently sitting around 19% below its February high. However, and more importantly, this does not include the return and reinvestment of dividends, which is a significant proportion of the total return for the ASX 200.

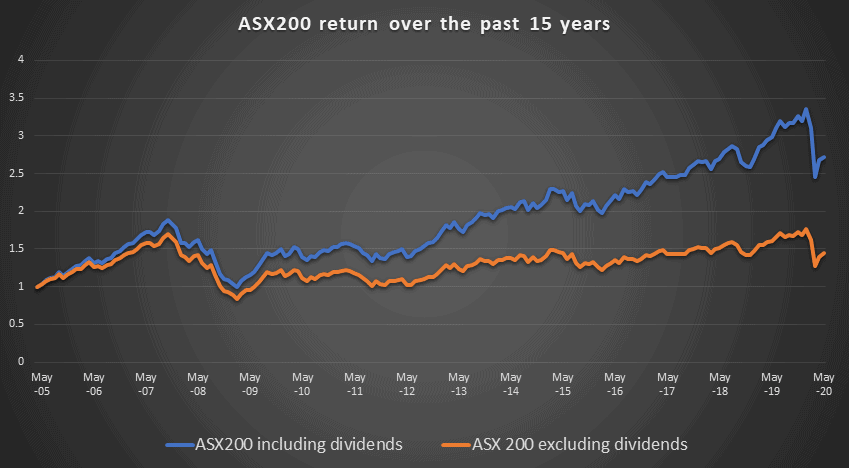

If we also include dividend return and reinvestments from the ASX 200, we see a return of around 96% across the past decade. This means your $50,000 investment would now be worth $98,000 – a gain of $48,000. This clearly shows how important dividends are when considering the total return. It's the reinvestment of these dividends where we see the wonder of compounding at work.

In fact, if we were to go back even further, we would get an even better idea of just how powerful the compounding effect is.

Going back 15 years, the ASX 200 with reinvested dividends has increased 172%. This size of return would turn your $50,000 into $136,000, giving you a capital gain of $86,000. That's a significant additional gain when we only added 5 years to the time period.

To highlight the benefit of dividend return and reinvestment, the chart below covering the last 15 years of ASX 200 growth clearly shows the advantage of compounding as the return 'gap' widens.

Data from Investing.com. Chart by author

Can you do even better investing in ASX shares?

The above hypothetical returns are fantastic, particularly considering not much thought is required if you simply wanted to track the returns of the ASX 200. There are a number of ETFs such as BetaShares Australia 200 ETF (ASX: A200), which make this task easy. However, it is possible to do even better if you manage to choose a company or group of companies that can outperform the market over the long term.

Even outperforming the ASX 200 by 1% or 2% each year can have a dramatic effect when these returns are compounded over a decade or two. The difference between an 8% annual return and a 10% annual return when compounded over 15 years is 100% – an 8% average return will increase your portfolio by 3.17 times and a 10% average return will increase your portfolio 4.17 times.

That means if you can consistently beat the market by 2% a year, then after 15 years your investment of $50,000 would be $50,000 better off than the market. Well worth pursuing the extra few percent I would say!

A couple of ASX shares to potentially invest in which I believe will outperform the market in the coming decade are Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) and Nearmap Ltd (ASX: NEA).