The S&P/ASX 200 Index (ASX: XJO) is up around 25% from its March lows. Nearmap Ltd (ASX: NEA), however has far outpaced the index, increasing by more than 125% over the same period. So are Nearmap shares still a buy at their current price?

Nearmap at a glance

Nearmap is an aerial imagery company which uses a subscription as a service model. It provides imagery which is much higher in resolution than satellite imagery and shows changes over time. It has a multi-year advantage over its closest competitors with a profitable Australia and New Zealand (ANZ) segment as well as a fast growing North America (NA) segment. The NA segment also includes Nearmap's newest market addition, Canada.

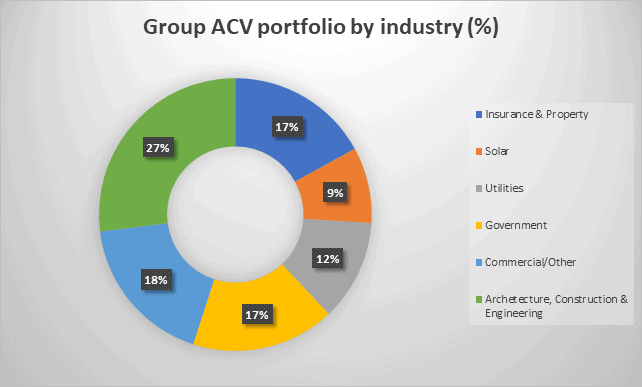

Supplementing the imagery, Nearmap's software provides a range of product features including orthogonal (2D) imagery, oblique cardinal direction imagery and 3D online and AI content. Its customer base is diverse, as shown below, with the product's primary appeal being the cost and time savings delivered through reduced reliance on site visits.

Data Source: Nearmap 1H FY20 analyst pack. Chart by author.

The market opportunity

Nearmap has a number of leavers to pull for growth. By expanding into new markets, growing its average revenue per subscription (ARPS), increasing gross margins and of course by growing its number of subscriptions. It appears there is a huge runaway potential.

The growth Nearmap is experiencing in its NA segment has accelerated past that of its more mature ANZ market. The NA portfolio offers a denser and larger market with an ARPS around double that of ANZ. However, the NA segment is not yet profitable since the company is still investing strongly there for future growth. Consequently, this means the company's current gross margin is only 17% for its NA segment. Compare this to the ANZ segment which delivered a gross margin of 88% for 1H20.

Nearmap's share price now

Nearmap's share price began dropping lower mid last year and was also heavily sold off prior to the market crash after updating its guidance. In addition, along with most growth shares, it was again significantly sold off during the coronavirus-led market crash. This left it sitting almost 80% lower within 12 months. Putting the recent 125% rise in perspective, it would still need to gain 120% to reach last year's high.

With so many events contributing to Nearmap's share price decline, its tough to decipher just how much of this fall has been justified. Pleasingly, the current trading conditions appear not to be materially impacting Nearmap. The company is also continuing to invest in growth initiatives.

In addition to annual contract value growth and segment performance, I will be looking to see a reduction in churn when Nearmap next updates the market. This has historically been low but recently doubled after the company lost a couple of significant customers in the autonomous vehicle industry. Nearmap has noted, however, potential future upside as the industry recovers.

Foolish takeaway

I like Nearmap shares and have been an owner for a number of years, holding through the crazy ride it has been of late. I believe in the company's future and can see Nearmap's NA segment following the same path its profitable ANZ segment took. Not to mention the potential for continued global growth Nearmap has cited. Think Singapore, the UK, Asia and Europe. Who knows where this ASX 200 tech could be in 5 or 10 years. I would be happy being a buyer today, provided you have the stomach to hold on and find out.