Well, finding this article means that you've already taken the first step. I think it's a great idea to plan how you want to structure your portfolio before buying any shares. These couple of steps can be very valuable in the long run. So, hopefully after reading this, you will be armed with enough information to take these steps.

While it is quite easy to open a brokerage account online, transfer money into it and purchase shares, the way you structure your portfolio is very important and should be your first consideration. After all, it can be difficult and expensive to change it down the road.

Your portfolio from a distance

I would suggest a well-diversified portfolio ranging across a variety of sectors and global economies. But don't panic. Gaining exposure to global economies is easy on the ASX through the use of exchange-traded funds (ETFs) and listed investment companies (LICs). Both ETFs and LICs trade each day on the exchange just like normal shares.

Just as there are many ways to skin a cat, there are many ways to structure a portfolio. This is highly dependent on personal needs and other assets owned by the investor, such as real estate. However, I believe the below portfolio structure would provide a great entry point for the average new investor.

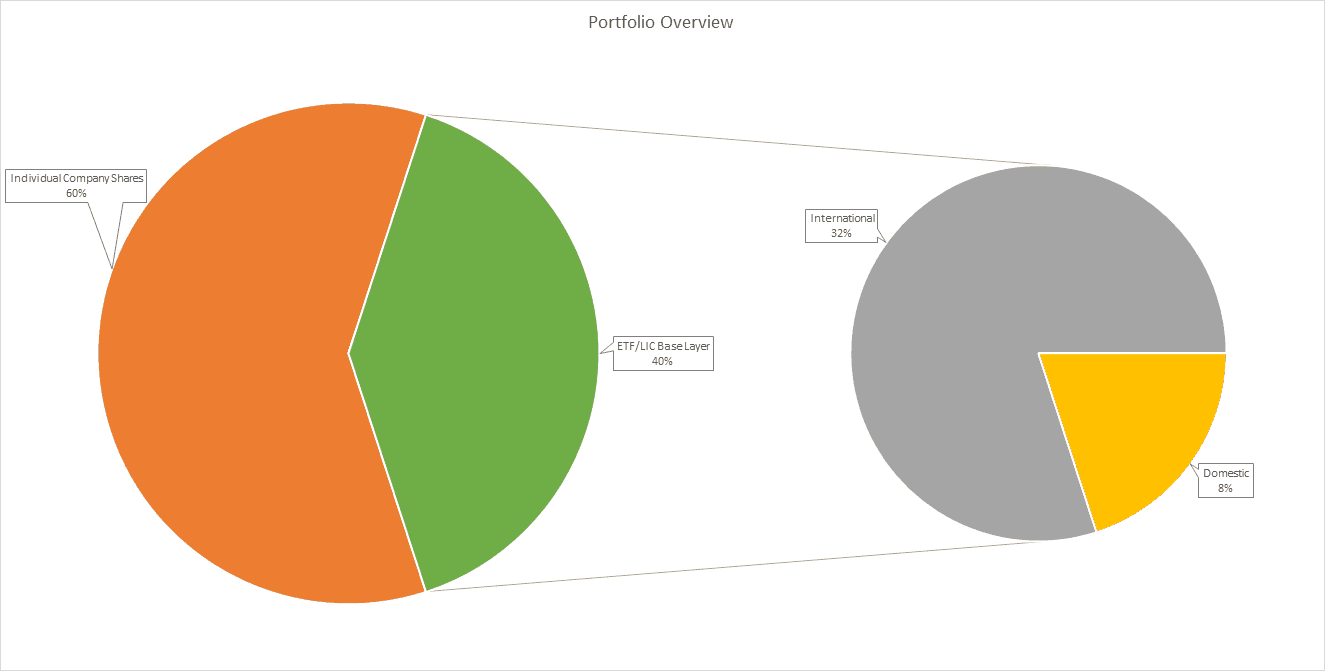

This example portfolio has 60% allocated to individual company shares and 40% allocated to the 'base layer' which consists of ETFs and LICs. Within this base layer allocation, 32% of the portfolio is weighted to international shares and 8% to domestic shares.

Buying ASX shares

The 'base layer'

I would start by building your 'base layer'. I like the idea of a base layer. It gives the portfolio a strong foundation of sector diversification and global exposure, shielding it from any significant shocks delivered by individual companies.

ETFs and LICs can provide investors access to a large number of companies through a single trade and usually track a particular index, sector, country or region. Therefore, this makes them great options for building international exposure and diversification into your portfolio.

Here are some ETFs and LICs I like which might be worth a closer look:

- BetaShares NASDAQ 100 ETF (ASX: NDQ) provides investors exposure to many of the largest tech companies in the world which are listed on the American Nasdaq exchange.

- WAM Global Ltd (ASX: WGB) invests in quality, undervalued international shares and is currently trading at a decent discount to its net tangible assets.

- BetaShares Asia Technology Tigers ETF (ASX: ASIA) invests in some of the largest tech companies in Asia, excluding Japan.

Individual company shares

This is the part of the portfolio which I think is the most exciting due to the potential for large company returns. However, it can be easy to get lost down the rabbit hole. So I think it's important for investors to do their own research and choose companies they can understand. Additionally, I believe a long-term focus is paramount and the source of truly great returns.

Your risk tolerance is another important consideration when buying ASX shares. Here you could steer your investments towards larger 'blue-chip' shares for lower risk tolerance, or add a few small to mid-cap companies with higher growth potential for a greater risk/reward trade-off. Either way, it's important to understand your financial needs and risk tolerance prior to making any of these investments.

Initially, I would suggest investing in at least 8-10 individual companies in addition to the 'base layer', with plans to grow this number and add more in the future.

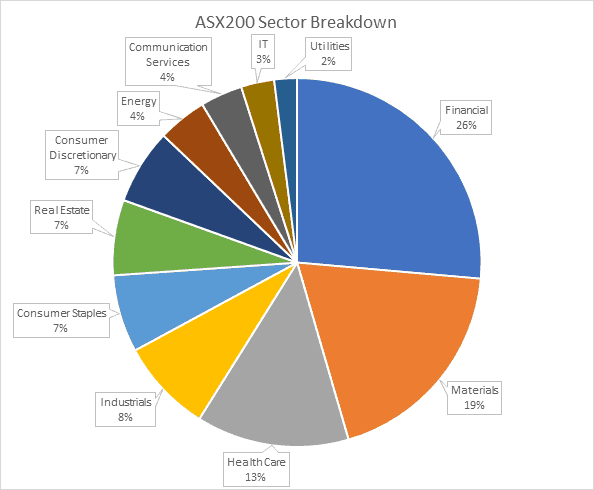

You should also still try to aim for diversification between your individual companies. The below chart shows the 11 sectors and their respective weightings in the S&P/ASX 200 Index (ASX: XJO). Here you can see that the ASX is heavily skewed towards financials, and I wouldn't suggest trying to structure your portfolio to match these weightings.

Rather, the chart does show the different ASX sectors to consider making investments in. And while I don't think you need to stress over finding an investment in all of them, I would suggest aiming for at least half.

Additionally, I would suggest not choosing too many companies in any single sector, but instead maybe choosing 2 or 3 of your favourite investment ideas from each sector you are investing in.

A few companies I currently like for the long term are Challenger Ltd (ASX: CGF), Audinate Group Ltd (ASX: AD8), Altium Limited (ASX: ALU) and Nearmap Ltd (ASX: NEA).

Foolish takeaway

Structuring your portfolio in this way provides it with strong diversification, while also giving you a chance to outperform the market by allocating over half of it to individual companies you believe will outperform in the long term.

While I would suggest checking in on your portfolio company and sector weightings from time to time, I wouldn't suggest trimming or readjusting too frequently. Instead, allow your winners to keep winning. This can lead to oversized returns and save on brokerage fees.

If you've decided that you want to start share market investing, take a look at the Fool's beginner's guide to investing in ASX shares.