The S&P/ASX 200 Index (Index:^AXJO) slumped deep into the red this morning even as our market exited April with its best monthly gain in more than 30 years.

The top 200 benchmark dived 3.6% at the time of writing after recording an 8.8% rally last month on hopes of a COVID-19 V-shape recovery.

The big falls may not be over if Warren Buffett's favourite market indicator is proven to be right yet again.

Looming market crash?

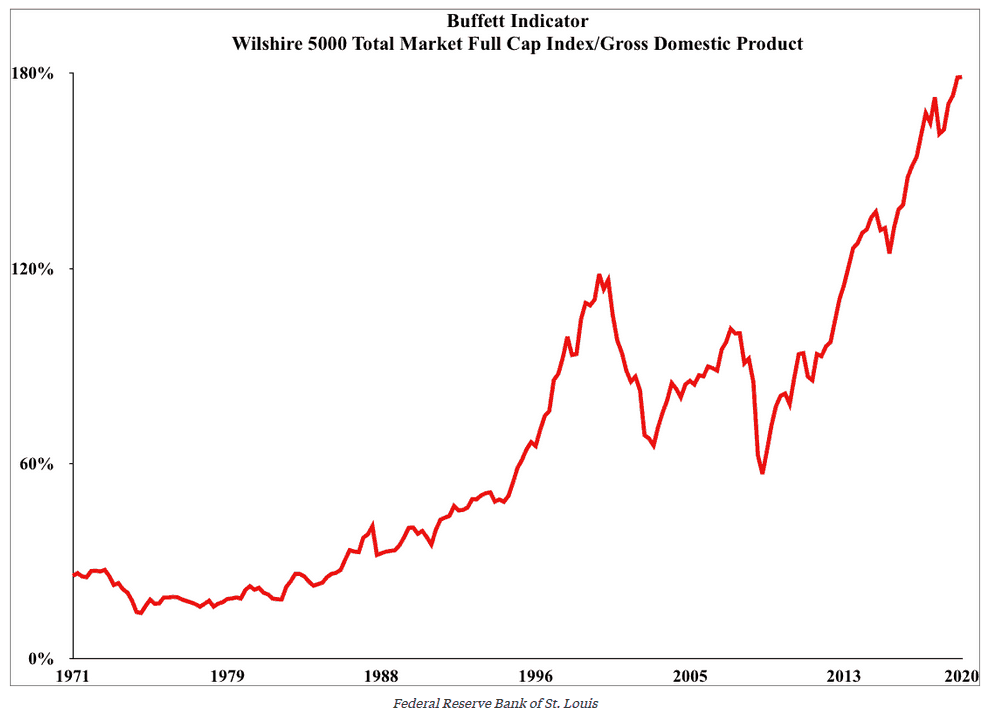

This share market predictor, called the "Buffet Indicator", just hit a record high which signals that the market is primed for a crash, according to Business Insider.

To be fair, the Buffet Indicator is measuring US equities and not the ASX. But if Wall Street takes a dive, it is hard to see how ASX shares can avoid a meltdown.

The indicator takes the total market capitalisation of US stocks and divides it by the quarterly gross domestic product (GDP) of the US.

Shares overvalued to size of economy

The idea is to test if shares are over- or undervalued relative to the size of the world's largest economy.

Warren Buffett described the indicator as probably the best single measure of market valuation, and followers of the Buffett Indicator have good reason to be worried.

Buffett Indicator set for dangerous new highs

While the indicator has hit a record high of 179% (compared to a 20-year average of 107%), it is almost guaranteed to surge to new heights in the coming months, unless we get a big market correction.

Source: Business Insider

Source: Business Insider

US equities have rebounded strongly since March as US GDP shrunk to 4.8% on an annualised basis in the first three months of 2020. But it's guaranteed that the US economy will crash even further in the June quarter with 30 million Americans filing for unemployment benefits.

That's larger than the entire population of Australia and equates to more than 16% of the American workforce.

Record contraction for US economy

This is prompting some economists to warn that US GDP in the current quarter could collapse by as much as 40% on an annualised basis. If this comes to pass, it will set another appalling record due to the coronavirus pandemic.

It will also push the Buffett Indicator to dizzying new heights should the share market not tumble by an equal or greater amount.

And in case you are wondering how accurate this indicator has been in forewarning previous crashes, it jumped to 108% just as the tech bubble popped in 2000 and hit 100% before the GFC in 2008.

Foolish takeaway

The news will give market bears new ammunition to use against the bulls, but I don't believe the indicator is perfect.

For one, GDP data is backward looking and doesn't account for the type of recovery we are expected to get post COVID-19.

It also doesn't account for the record levels of cheap money that central banks are pumping into the financial system, nor does it consider offshore earnings from US companies.

Having said that, the ASX 200 rebounded a little too fast for my liking, although I still believe that the ASX 200 low hit on 23 March will hold.

What this means is that I will be buying any big dip in the market.