There's an old saying out there – whispered amongst old ASX investors who have been practising their craft for decades – that goes along the lines of "sell in May and go away".

For some reason, it's something of an investing 'old wives tale' that each May, like clockwork, the ASX enters a mini-bear market – and investors would do well by selling out of everything for a few months.

If this sounds like foolish folly to you (and not the good kind of Foolish), I would agree.

But I thought I would do something of a very simple test for this theory, so we can put it to bed for this year as we start the month of May – and perhaps prevent some of the more gullible investors out there from making a potential mistake.

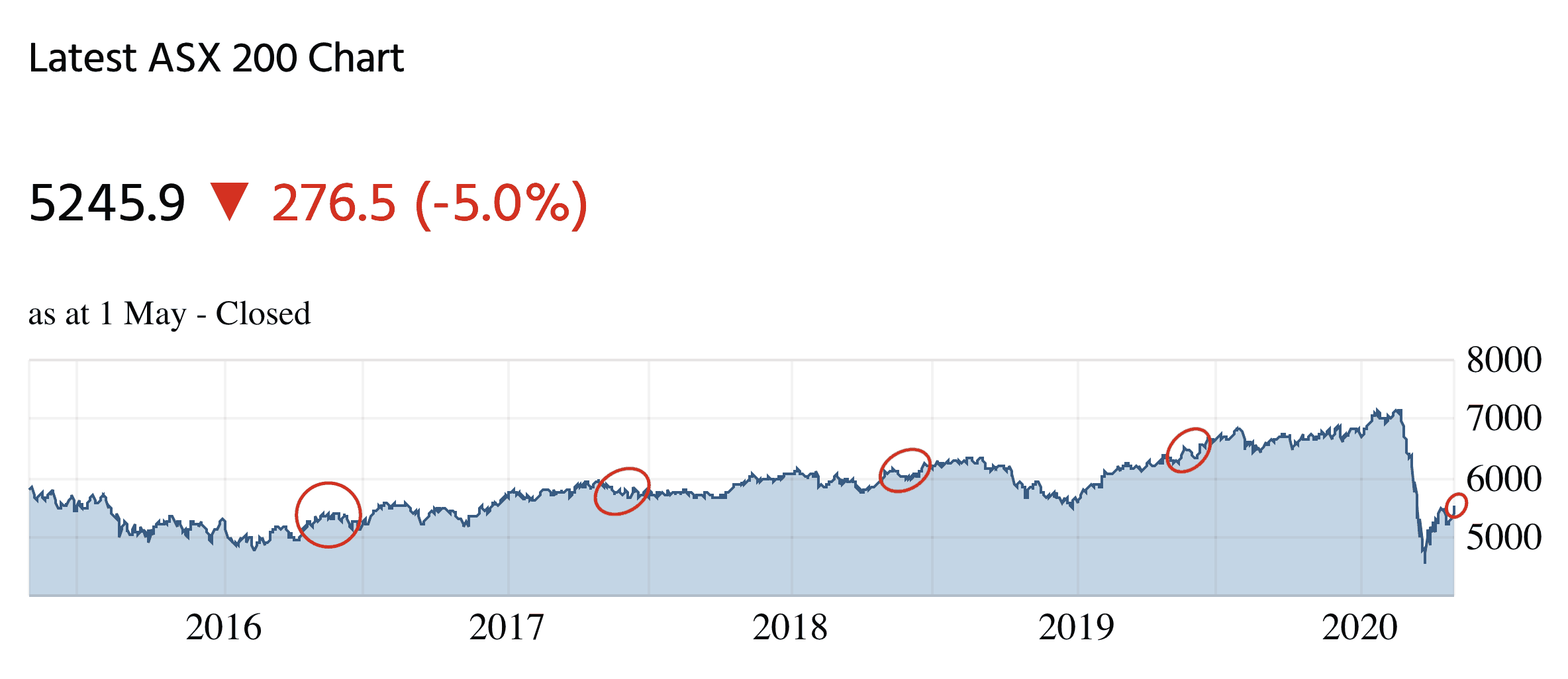

So below, you can see a graph of the S&P/ASX 200 Index (ASX: XJO) going back over the last 5 years. I have circled the start of each May in red, as you can see:

What did you draw from this? Nothing spectacular? Me too!

From what my (very basic) analysis tells me, of the last 4 Mays, 3 have not seen a subsequent decline in the value of ASX shares in the weeks and months afterwards.

And the 1 year that did see a decline, I wouldn't call it enough to warrant massive sell orders. The 'sell in May' dictum doesn't give us a buy-back-in time either, so that's up to the individual and another reason why this proverb is folly.

Here's what I do know

The market is a fairly rational wealth-creating mechanism, but it is also subject to emotional irrationality, especially over short periods of time. Even if it was a good idea to 'sell in May and go away', why would you want to? Is the business you own a share that's somehow allergic to winter?

If you owned a share of your local grocery store, would you want out in May and ask to buy back-in in September?

Having a proper perspective of what owning ASX shares really means would tell you that selling your business ownership based on the static cycle of the Gregorian calendar year doesn't make much sense. If my ASX shares, my businesses, made a fundamental mistake, got themselves into trouble or did something else calamitous that happened to fall in May, I might sell. But otherwise, I plan to manage my portfolio over May in exactly the same as every other month of the year.