The Federal Government recently announced that Aussies would be able to make a $10,000 super withdrawal as part of the economic stimulus measures to fight the coronavirus pandemic. As of 22 March, financially stressed people will be allowed to tap into those mandatory retirement accounts.

Now, for many, this withdrawal will be needed immediately to cover food, housing and similar basic expenses. But just how much impact would a $10k super withdrawal have on your retirement?

Why you should avoid the $10k super withdrawal if you can

The S&P/ASX 200 Index (ASX: XJO) is down 22.40% since the start of March and we're firmly in a bear market. That means any withdrawals now, assuming you were in some reasonably high-growth assets, would be booking a loss.

Markets are volatile right now, but if you buy and hold quality ASX 200 shares, you should be OK. Markets will bounce back from this and share values will rise again. Selling now, however, rules you out of that recovery to spend today.

It's important to note that age really matters here. For instance, if you're aged 50+ and looking at retirement soon anyway, a $10k withdrawal really doesn't matter much. But if you're a young Aussie, a $10k super withdrawal now could have huge ramifications in the future. And that's not the only thing to consider when drawing down your retirement funds today. The thing with compounding returns is, the more time you have, the stronger the gains.

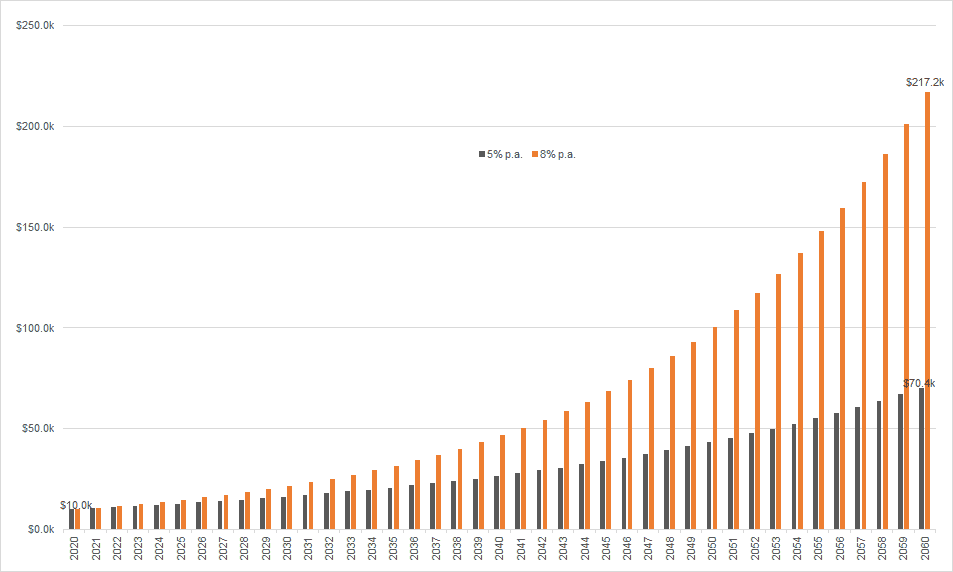

Let's take a look at a little example I did below. For a 25-year-old Aussie who is looking to use the $10k super withdrawal, this is the potential impact on their retirement balance at age 65. One scenario assumes a 5% per year share market return and the other assumes 8% per year.

It's clear that a $10k super withdrawal today is the equivalent to a $217,200 withdrawal at age 65, assuming an 8% annual return. These are big numbers, and one of the main reasons why you should avoid touching your super if you can.

Foolish takeaway

Many Aussies at the moment will be struggling to pay the bills. These are unprecedented times for us, with a health crisis and an economic crisis staring us in the face. The $10k super withdrawal is aiming to provide those in need with access to other funds. However, I think this is best used as a last resort given the potential hit that it could have on your retirement.